Previous:

Trading on the euro/dollar pair closed down on Monday. Sellers almost completely annulled Friday’s gains. The euro fell against the dollar to 1.1770, after which a phase of consolidation began. A growth in US bond yields provided support for the dollar, which was helped by a de-escalation in rhetoric from the US towards North Korea as well as demand for more risky assets. US 10Y bond yield rose to 2.228%.

Day’s news (GMT+3):

- 09:00 Germany: GDP (Q2).

- 10:15 Switzerland: producer and import prices (Jul).

- 11:30 UK: retail price index (Jul), CPI (Jul), CPI core (Jul), PPI – input (Jul), PPI – output (Jul), DGLC house price index (Jul).

- 15:30 USA: retail sales (Jul), retail sales control group (Jul), NY Empire State manufacturing index (Aug), import price index (Jul).

- 17:00 USA: business inventories (Jun), NAHB housing market index (Aug).

- 23:00 USA: total net TIC flows (Jun).

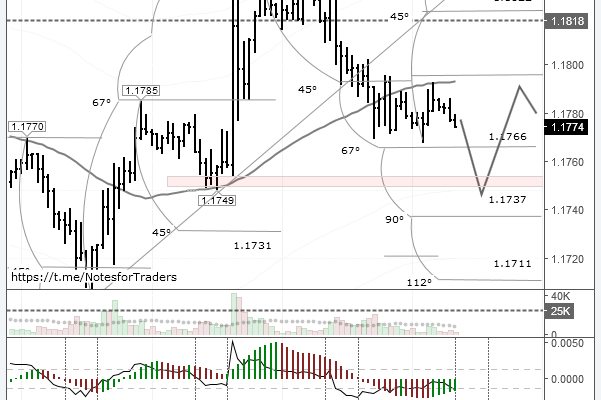

EUR/USD rate on the hourly. Source: TradingView

My expectations for the euro on Monday came off in full. Sellers broke through the trend line, pushing buyers back to 1.1770. The 45th degree didn’t hold up. Growth on the euro/yen cross wasn’t enough for buyers to defend 1.1793.

During trading in Asia, the euro fell to 1.1754. In my forecast today, I’m expecting a drop to 1.1737 followed by a rebound and subsequent growth to 1.1790. The euro is falling because of a sharp rise in US bond yields by 2.55% to 2.25%. As a guide, I’ve chosen the low from the 11th of August of 1.1749. If the rate drops to 1.1737, it will have completely covered Friday’s range.

Still, if the price reaches this level, don’t be in a hurry to buy euros. We need to wait and see how buyers will behave themselves around here, what sort of volume there will be and where the hourly indicators are at this time. It’s difficult to reflect the dynamics of these indicators in a static review, no less explain how they will change with time.