European markets continued their risk-on trend in early trading, rising to the highest in over a week and rallying from the open led by mining stocks as industrial metals spike higher after zinc forwards hit highest level since 2007, lifting copper and nickel. The EUR sold off sharply, boosting local bond and risk prices after the previously discussed Reuters “trial balloon” report that Draghi’s speech at Jackson Hole would not announce the start of the ECB’s taper. The EUR/USD has found support at yesterdays session low. Bunds have rallied in tandem before gilts drag core fixed income markets lower after U.K. wages data surprises to the upside. Early EUR/JPY push higher through 130.00 supports USD/JPY to come within range of 111.00.

In Asia, Japan’s JGB curve was mildly steeper after the BOJ continued to reduce its purchases of 5-to-10-yr JGBs; the move was consistent with the BOJ’s desire to cut back whenever markets stabilize, according to Takenobu Nakashima, strategist at Nomura Securities Co. in Tokyo. The yen is little changed after rising just shy of 111 overnight. The S.Korean Kospi is back from holiday with gains; The PBOC weakened daily yuan fixing; injects a net 180 billion yuan with reverse repos; the Hang Seng index rose 0.9%, while the Shanghai Composite closed -0.2% lower. Dalian iron ore declines one percent. Japan’s Topix index closed little changed. South Korea’s Kospi index rose 0.6 percent, reopening after a holiday. The Hang Seng Index added 0.8 percent in Hong Kong, while the Shanghai Composite Index fell 0.2 percent. Australia’s S&P/ASX 200 Index advanced 0.5 percent. Singapore’s Straits Times Index was Asia’s worst performer on Wednesday, falling as much as 1.1 percent, as banks and interest-rate sensitive stocks dropped.

The Stoxx Europe 600 Index rose 0.7%, the highest in a week.The MSCI All-Country World Index increased 0.3%. The U.K.’s FTSE 100 Index gained 0.6%. Germany’s DAX Index jumped 0.8% to the highest in more than a week. Futures on the S&P 500 Index climbed 0.2% to the highest in a week. Global markets are finally settling down after a tumultuous few days spurred by heightened tensions between the U.S. and North Korea. Miners and construction companies led the way as every sector of the Stoxx Europe 600 advanced as core bonds across the region declined. Crude gained for the first time in three days after industry data was said to show U.S. inventories tumbled 9.2 million barrels last week.

U.S. stock-index futures rise slightly with European and Asian equities and oil. Data include MBA mortgage applications and housing starts. Cisco, Target, L Brands and NetApp are among companies reporting earnings. Italian banks also outperform after HSBC make positive comments on Intesa Sanpaolo and Unicredit.

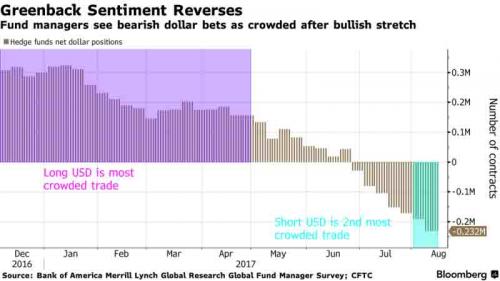

In overnight macro, the Bloomberg Dollar Spot Index was unchanged after two days of gains and Treasury yields edged higher as European stocks rose and investors awaited minutes of the Fed’s July 25-26 meeting. As shown in the chart below, after “Long USD” was seen as the “most crowded traded” for months until the start of Q2, the BofA Fund Manager Survey respondents now “Short USD” as the second most crowded trade.

In Asia The yen slid a third day against the dollar as market participants positioned themselves ahead of the FOMC minutes and as geopolitical tensions on North Korea abated; Australia’s dollar gained for the first time in three days as traders covered short positions after second-quarter wage data matched estimates, boosting prospects of an upbeat July employment print this week. The pound rose against the dollar as a U.K. labor-market report showed wage growth exceeded the median estimate of economists and unemployment unexpectedly dropped to the lowest since 1975.

The latest European data released overnight showed more nations joined the recovery as the euro-area economy gathers pace. Italy’s economy expanded for a 10th straight quarter, matching estimates of a 0.4% increase while growth in the Netherlands beat economists’ estimates.

Eastern European economies including Romania, the Czech Republic and Poland also exceeded expectations, confirming that a broad-based recovery is taking hold.

In rates, the yield on 10-year Treasuries climbed one basis point to 2.28 percent, the highest in more than two weeks.Germany’s 10-year yield increased three basis points to 0.46 percent, the highest in more than a week. Britain’s 10-year yield gained four basis points to 1.121 percent, the highest in more than a week.

In today’s key event, minutes from the Fed meeting will be parsed closely; policy makers have indicated they may announce plans to reduce the central bank’s balance sheet in September and then potentially raise interest rates again this year.

Global Market Snapshot

- S&P 500 futures up 0.2% to 2,468.90

- STOXX Europe 600 up 0.8% to 379.51

- MSCI Asia up 0.2% to 158.83

- MSCI Asia ex Japan up 0.5% to 523.28

- Nikkei down 0.1% to 19,729.28

- Topix down 0.01% to 1,616.00

- Hang Seng Index up 0.9% to 27,409.07

- Shanghai Composite down 0.2% to 3,246.45

- Sensex up 0.7% to 31,664.31

- Australia S&P/ASX 200 up 0.5% to 5,785.10

- Kospi up 0.6% to 2,348.26

- German 10Y yield rose 1.5 bps to 0.448%

- Euro down 0.2% to $1.1717

- Italian 10Y yield rose 2.5 bps to 1.756%

- Spanish 10Y yield fell 0.4 bps to 1.469%

- Brent futures up 0.7% to $51.16/bbl

- Gold spot down 0.06% to $1,270.71

- U.S. Dollar Index up 0.09% to 93.94

Overnight Top News

- Fed’s Fischer: Will probably be a break between announcement of unwinding of QE and the start of the process; Fed could always press pause if unanticipated circumstances arise: FT

- ECB President Mario Draghi will not deliver a new policy message at the

Fed’s Jackson Hole conference, Reuters reports, citing two unidentified

people familiar with the situation - Efforts to loosen constraints on banks 10 years after financial crisis are “dangerous and extremely short-sighted,” Fed Vice Chairman Stanley Fischer says in FT interview

- Kaplan repeats Fed should be patient on timing of next hike; should start balance sheet unwind very soon

- ECB’s Hansson: Wage pressures are beginning to emerge despite low

inflation in the euro area but are “very uneven†across the bloc - Trump Again Drags GOP Onto Dangerous Ground, This Time Over Race

- Euro-area GDP rose 0.6% q/q in 2Q, in line with the median estimate of economists, and was supported by continued growth in Germany, the region’s largest economy, and the strongest Spanish performance in almost two years

- Holders of credit-default swaps in Banco Popular Espanol SA still haven’t been compensated after the bank’s junior notes were wiped out in Europe’s first forced sale of a failing lender under its new resolution regime

- German Finance Minister Wolfgang Schaeuble doesn’t share opinion of German Federal Constitutional Court about ECB policy, Handelsblatt reports

- Bank of Japan cut purchases of bonds maturing in five to 10 years by 30 billion yen ($270 million) to 440 billion yen at its regular debt-buying operations on Wednesday

- The 220 billion-krone ($28 billion) Government Pension Fund Norway, the domestic counterpart of the country’s sovereign wealth fund, is cutting risk as big active bets have lost their luster

- API inventories according to people familiar w/data: Crude -9.2m; Cushing +1.7m; Gasoline +0.3m; Distillates -2.1m

- BOJ cuts purchases of 5-to-10 year bonds by 30 billion yen

- China’s Treasuries holdings up $44.3 billion in June to $1.15 trillion

- Uber Lines Up 4 Investors, But a Deal Hangs on Boardroom Battle

- Elliott Says BHP Taking Note of Critics as Fund Lifts Stake

- Akzo, Elliott Call Truce as CEO Gains Breathing Space for Split

- Urban Outfitters Gains After Smaller Chains Prop Up Results

- Netflix Co-Founder to Sell Ads to Pay for $10 Movie Pass

- Apollo Is Said to Sweeten ClubCorp Debt Deal as Buyers Balk

- Italian Economy Expands, Boosting Optimism on Recovery