The persistence of low inflation will be a key topic at the Federal Reserve’s at the Jackson Hole Symposium that starts on Friday (Aug. 24). But as the world’s monetary elite prepare to discuss the finer points of “Fostering a Dynamic Global Economy,â€Â Treasury yields are once again sliding, which implies that the crowd is anticipating that pricing pressure will weaken.

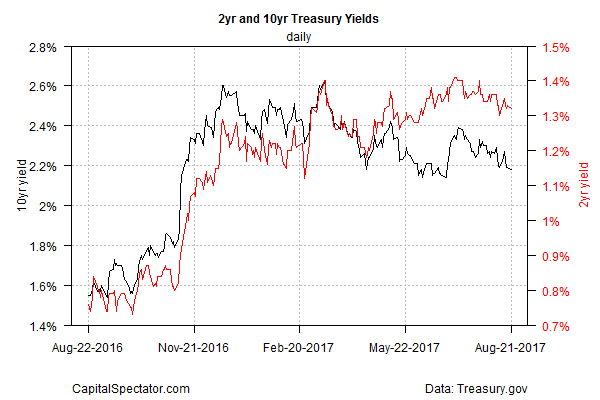

The benchmark 10-year Treasury yield dipped to 2.18% yesterday (Aug. 21), the lowest rate since late-June, based on daily data via Treasury.gov. The 2-year yield, which is widely monitored as a gauge for near-term monetary policy expectations, has also been trending lower over the past month, edging down to 1.32% on Monday, or just two basis points above last week’s 1.30% trough – a two-month low.

Lower yields have been accompanied by softer market-based inflation forecasts in recent weeks. The implied inflation rate via the yield spread on the nominal 5-year Treasury less its inflation-indexed counterpart fell to 1.59%, which matches last week’s nadir as the lowest estimate since late-June.

Official measures of inflation are relatively low too. The personal consumption expenditures price index, which the Fed monitors closely, increased just 1.4% in June vs. the year-earlier level, well below the central bank’s 2.0% inflation target.

Fed Chair Janet Yellen has recently said that she expects pricing pressure to firm up in the near term, but so far there are few signs that a change is underway. As for the Fed’s general outlook, the minutes of the Federal Open Market Committee for July 25-26 stated that “participants expected that inflation on a 12-month basis would remain somewhat below 2 percent in the near term. However, most participants judged that inflation would stabilize around the Committee’s 2 percent objective over the medium term.â€

The Treasury market hasn’t fully discounted that projection, but it’s clear that the crowd’s confidence in the Fed’s outlook has frayed recently. The 10-year/2-year yield spread, for instance, has declined substantially this year, falling to 86 basis points yesterday (Aug. 21), down from a 125-basis-point spread at the close of last year.