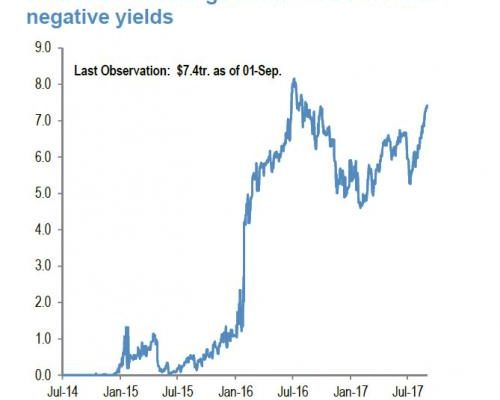

Two weeks ago, we were surprised to find that despite the recent “growth promise” of what has been called a coordinated global recovery, the market value of bonds yielding less than 0% had quietly jumped by a quarter in just one month to the highest since October 2016.

Since then, the paradoxical divergence between the reported “strong” state of the “reflating” global economy and the amount of negative yielding debt, has only grown, and as JPM reports as of Friday, Sept. 1, the global market value of government bonds trading with negative yield within the JPM GBI Broad index rose to $7.4 trillion, up 60% from its low of $4.6 trillion at the beginning of the year.

Some more details from JPM:

We calculate the market value by multiplying the dirty price with the amount outstanding for each bond within JPM GBI Broad Index and then convert it to US dollars at today’s exchange rate. The market value of bonds trading with negative yield,including central banks’ purchases, stands at 30% of the total JPM GBI Broad index.

What makes the latest rise in negative yielding debt especially bizarre is that it was mainly driven by Japan, where 10-year government bond yields have fallen significantly over the past month and have turned negative this week for first time since the US presidential election, even as the Bank of Japan has twice in the past month reduced the amount of JGB debt it purchases in the open market in the 5-to-10 year bucket, following on Friday, by a 30BN yen reduction of buying in the 3-to-5 year debt range.

As a result, the total universe of Japanese bonds trading with negative yield within the JPM global government bond index (GBI Broad) now stands at $4.6tr, or 62% of the outstanding amount. The remaining government bonds trading with negative yields worth $2.8 trillion are from Europe, of which more than half are from France and Germany.