And we’re back at all time highs.

With traders paring back risk positions on Friday ahead of a weekend full of potential risk events, Monday has seen a global “risk-on” session in which global stocks rose back to record highs and US futures jumped, the dollar gained, Treasuries retreated, while VIX and dollar slumped as appetite for risk returned to global markets after North Korean failed to conduct an anticipated missile test failed to materialize and Hurricane Irma appears to have struck the U.S. with less force than feared. The MSCI All-Country World Index increased 0.3% to the highest on record with the largest climb in more than a week, while that “other” trade also outperformed, as the MSCI Emerging Market Index increased 0.4% to the highest in about three years. Safe havens such as the yen and Swiss franc all also fell.

Amid the risk-on tone, the dollar registered its biggest gains in the currency markets in ten days. It added 0.5 percent against its perceived safe-haven Japanese counterpart the yen JPY and clawed back ground against the high-flying euro as an ECB policymaker flagged caution about the single currency’s recent rise.Â

“The good news was that the eye of Hurricane Irma took a path west of Miami and has since weakened to a Category 1 storm so that damage in Florida – whilst still severe… appears not to be quite as catastrophic as had been feared last week,†said Daiwa Capital Markets strategist Chris Scicluna. “And thankfully there was no bad weekend news out of North Korea either.â€

As Bloomberg summarizes the post-weekend action, it was marked by the unwind of risk-off related hedges after the impact of Hurricane Irma is smaller than initially feared and North Korea does not conduct any military activity over the weekend. JPY and CHF consequently underperform; Yuan continues to weaken after PBOC removed reserve requirement on FX forwards. DXY retraces overnight rally to trade flat, EMFX rallies against USD. European equity markets rally strongly from the open, insurance sector leads relief rally followed by financial services. Bund and UST curves both bear steepen, 10Y futures gap lower and stay within a tight range, similar move in spot gold. Industrial metals rally after China inflation data; Brent-WTI spread tightens after Friday’s sharp widening move.

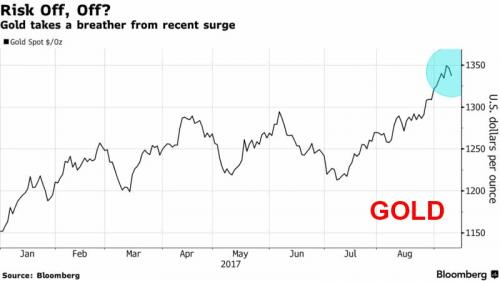

Gold sank 0.7 percent to $1,337.62 an ounce, the biggest dip in almost four weeks, although it still remains at notably elevated levels as shown below.

The Stoxx Europe 600 Index jumped the most in more than a week, rising for the fourth day, as all the region’s major stock gauges advanced and almost every sector gained. Earlier, equities across Asia traded in the green. Oil advanced as Gulf Coast refining capacity continued to recover after getting hit by Harvey. Stoxx 600 up 0.95% to 379.08, with insurers leading gains after three straight weeks of declines, amid relief that any impact from storm damages in the U.S. may be less than anticipated.

In Asia, the MSCI Asia-Pacific Index jumped 0.6 percent to hit the highest since December 2007. The Topix index advanced 1.2 percent at the close in Tokyo, its steepest advance since early June. Japan’s Nikkei rose 1.4 percent after Pyongyang held a massive celebration to congratulate the nuclear scientists and technicians who steered the country’s sixth and largest nuclear test a week earlier. South Korea’s Kospi index rose 0.7 percent as did the S&P/ASX 200 Index in Sydney. Hong Kong’s Hang Seng Index rose 1 percent, while gauges in China fluctuated. The Japanese yen sank 0.6 percent to 108.44 per dollar, the biggest dip in almost four weeks.

“It’s too early to say the (North Korean) risks are gone, but one thing for sure is that market players now think the situation won’t get worse as it did some weeks ago,†said Lee Kyung-min, a stock analyst at Daishin Securities in Seoul. Lee said many foreign investors and domestic institutions were purchasing South Korean tech and chemicals shares as quarterly earning season neared.

Continuing Friday’s action, the onshore yuan headed for its biggest decline in 8 months, with sentiment taking a hit after China’s central bank removed trading curbs on foreign-exchange forwards.

“The removal potentially makes it easier for traders to purchase the USD, easing the pressure for yuan appreciation,†said analysts at ANZ in a note. “The change likely signals some discomfort about the stronger yuan and its impact on Chinese exports.â€

As a result, the CNY weakened 0.55% to 6.5246 per dollar, set for the biggest drop since January on a closing basis. The PBOC strengthenedthedaily reference rate for 11th day, longest run since 2005; sets it 0.05% stronger at 6.4997 per dollar, however, this was weaker than the 6.4834 average forecasts from a survey of 16 traders and analysts. In offshore markets, the CNH dropped 0.51% to 6.5290 per dollar in Hong Kong. Perhaps in an attempt to limit losses, the central bank once again intervened by boosting margin costs, and the overnight CNH Hibor rose 78 basis points, the most since June 1, to 2.29433%. One- month CNH borrowing cost climbs 50 basis points to 3.60633%.

Also in China, August inflation readings were above market on Saturday and confirmed the rise in pricing pressure seen in the PMI data earlier in the week. The CPI rose +0.4% mom, lifting annual growth to +1.8% yoy (vs. +1.6% expected), which is the fastest pace since January. This partly reflects a smaller deflationary contribution from the food sector (prices now down just -0.2% yoy). However, non-food inflation picked up three-tenths to +2.3% yoy. Elsewhere, a +0.9% mom rise in August PPI saw through-year inflation measured at the producer level rise to +6.3% yoy (vs. +5.7% expected).