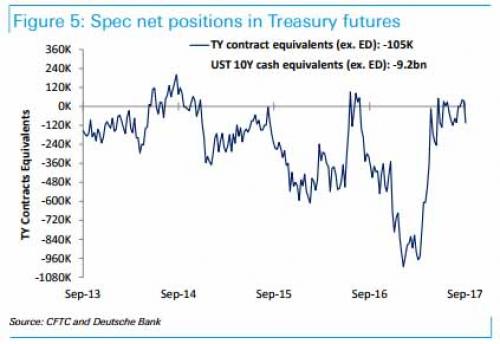

With the 10Y nearly touching a 1-handle ahead of this weekend’s battery of potential risk-off events, none of which however materialized in their worst-case outcome, many are once again calling for a bottom on yields, especially as net spec shorts rose over the past week according to the latest CFTC COT data.

And yet, not everyone is convinced that “this time is different.” As Bloomberg macro commentator Wes Goodman writes overnight, “after the U.S. 10-year yield fell to just above 2%, what’s next? It’d be easy to say it should snap back to a range of 2.3% to 2.5%, especially after it jumped at Monday’s open. But that’d be too boring. That’s the consensus view.” Instead, Goodman joins a small group of rates bulls who believe that despite today’s risk-on euphoria, the next move in yields will be down, not up, and list the following reasons why “the world benchmark for borrowing costs can drop below 2%.”

His full note below: