Investors have committed more than $35 billion to the Vanguard REIT ETF (VNQ) making it the 19th largest ETF in the marketplace. Despite its size and success, the fund is about to make some changes and dividend investors might not like it.

The REIT ETF has a good long-term track record, but 2017 has been a different story. Its 5.1% year-to-date return is well behind the 10% return of the S&P 500 Real Estate Index. The main reason for this year’s underperformance is a relatively narrow real estate index that’s missing out on some of the sector’s biggest winners this year. Its current benchmark, the MSCI US REIT Index, notably excludes both mortgage REITs and selected specialty REITs, such as real estate services and real estate development companies. That’s where some of 2017’s top performers, such as American Tower (AMT) and Crown Castle (CCI), reside. As a result, Vanguard has put a proposal in front of shareholders that would change the fund’s tracking index to something more inclusive.

The REIT ETF’s index is expected to change to the MSCI US Investable Market Real Estate 25/50 Index sometime in early 2018. The new index would add the previously mentioned REITs to the mix as well as a handful of other specialty products. While it may not seem like a big deal in the grand scheme of things, it actually does have implications on both risk and income.

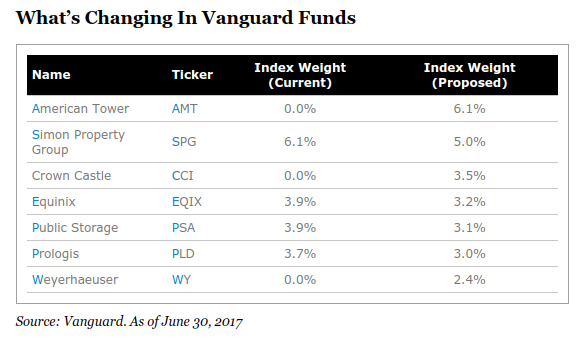

First, let’s take a look at how the fund’s top holdings are expected to change.

Three of the top seven holdings, and about 12% of fund assets just from those three holdings alone, will be new to the fund. Year-to-date, American Tower is up 39%, Crown Castle is up 25% and Weyerhaeuser (WY) is up 12%. Is there a bit of performance-chasing that is motivating Vanguard to make this move? Perhaps. I’m not sure that Vanguard makes this change if the currently absent REITs and other securities are underperforming this year, but the move to target a more expansive diversified universe of real estate securities should be one that serves it well over the long-term.