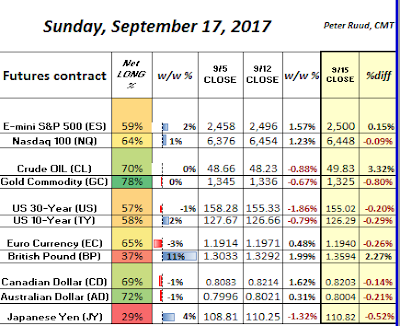

The most significant move in futures positioning (into September 12th) was with the British pound, as sentiment improved markedly heading into last week’s Bank of England (BOE) meeting.The Monetary Policy Committee provided the markets with the 2nd hawkish surprise by a central bank in as many weeks, helping thrust Sterling to post-Brexit highs and interest rates (globally) to recover off 2017 lows. The latest Commitment of Traders (COT) report also highlighted the continued unwind of the yen carry-trade, prior to last week’s reversal in the “risk-on” trade, which has seemingly caught traders off-guard.Meanwhile, US equities continue to chug along, as the major averages collectively trade at or near all-time highs as next week’s focus shifts to the Federal Reserve.

The British pound soared to fresh post-Brexit highs after the BOE unexpectedly hinted at an imminent rate hike. UK bond yields and the sterling both soared as the market was clearly caught off-guard. According to the most recent COT report, large speculators were increasing their long exposure heading into meeting, adding the most amount of (gross long) contracts since April. Meanwhile, retail FX traders continued to fight Sterling strength all week long, as retail FX optimism sunk to near the lowest level for the year. That said, both times retail sentiment reached these levels (this year), the pound had begun to top-out. Large speculators, however, seemingly under-own sterling and are clearly increasing their exposure to the British currency. This hints of a re-test of the 1.3831/1.3948 region either immediately or once overbought headwinds are unwound a bit. Look for the 1.35 psychological region to cushion dips to the downside.

Â

The EUR/USD has pushed through the psychological 1.20 mark twice, but has failed to close above it. This puts the single currency in peculiar spot, where the trend is clearly higher, but the ascent looks a bit exhausted. The 10-month improvement in euro positioning has stalled as of late, but remains near the largest net long position by (non-commercial) speculators on record. Meanwhile, according to recent retail FX traders positioning data, the retail population looks to be increasing their euro exposure. This is probably due to negative market psychology towards the US dollar that is feeding into the minds of retail traders, who are notoriously late when it comes to moves in the market. If the 1.1840 region remains supportive, the next key (upside) objective is 1.2138 or the mid point of the overall range since 2014. If euro strength, however, were to stall anywhere ahead of the 1.2070 area (to the upside), then it could set the stage for a broader correction.

Â