The day has finally arrived: today the Fed will officially announce the start of its balance sheet shrinkage (full preview here) while keeping rates unchanged, perhaps hiking again in December (market odds at 56%), while revising its economic projections and “dots”, most likely in a lower direction.

And while we wait for the announcement and press conference after 2pm, US index futures – as well as European and Asian equities – are little changed, signaling a pause for Wall Street’s three major benchmark indexes after they hit new all-time highs ahead of the Federal Reserve’s policy announcement due today. They probably will not be changed after 2:30 pm, however, especially if Yellen surprises on the hawkish side. Don’t look at the dollar for clues though: The DXY fell less than 0.1% against a basket of major currencies and was down against the euro, the yen and sterling. The Bloomberg Dollar Spot Index fell a second day, with the U.S. currency confined to a narrow trading range, as Treasury yields edged lower; broad lack of directional catalyst seen over the session as traders awaited the FOMC decision.

“If we move closer to a U.S. rate hike, that should come along with a bit more dollar strength and euro weakness which would harden the ECB’s exit case and be a headwind for government bonds,†said Commerzbank strategist Rainer Guntermann.

Ahead of the Fed, Europe’s Stoxx Europe 600 Index was mixed alongside S&P 500 futures and a fractionally higher session for Asian equities. The dollar slipped, the euro and yen gained and the British pound jumped as data showed U.K. retail sales rose more than forecast in August. Spanish assets showed resilience even as the government stepped up its crackdown on an illegal separatist referendum planned for the Catalonia region. The Mexican peso swung after a 7.2 magnitude earthquake struck. Benchmark crude rose but struggled to break $50 a barrel. US Treasuries halted a three-day decline awaiting the Fed’s interest-rate projections. New Zealand’s dollar led gains versus the greenback after an election poll showed the ruling National Party ahead, while the pound advanced after U.K. retail-sales data beat forecasts.

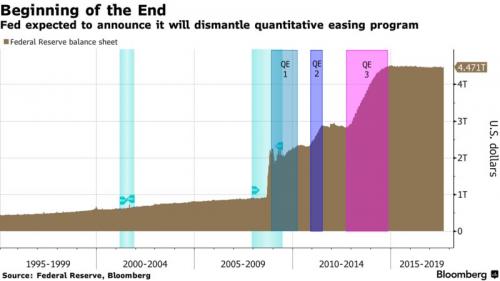

Financial markets remain largely calm – even after President Donald Trump used a UN speech to threaten to annihilate North Korea – as all eyes turn to Wednesday’s Fed decision. Expectations are high that the central bank of the world’s biggest economy will unveil plans to start shrinking its $4.5 trillion balance sheet, while any clues on the chances of a rate increase this year could tip the balance – market expectations of another hike in 2017 are at about 50 percent.

Asian stocks swung between gains and losses as investors awaited the Fed. The MSCI Asia Pacific Index rose 0.2 percent to 164.44 even as most shares declined, after earlier falling by the same magnitude; the gauge closed Tuesday at its highest level since December 2007. The Topix index ended the session in Tokyo almost flat at the highest since August 2015. Australia’s S&P/ASX 200 and the Kospi index in Seoul closed slightly lower. The Hang Seng Index in Hong Kong swung between gains and losses with the Shanghai Composite Index, before both advanced.Telecommunications and energy stocks advanced, while utilities and consumer shares slipped. SoftBank Group Corp. was the biggest boost the gauge while Sony Corp. was among the biggest drags after Credit Suisse Group AG downgraded the stock, saying earnings may plateau in fiscal 2019. Japanese shares fluctuated in a narrow range throughout Wednesday’s session as investors awaited the outcome of the U.S. Federal Reserve’s policy meeting. The benchmark Topix index ended little changed, with about five shares declining for every four that rose. Nintendo Co. and telecommunications companies provided the most support, while chemicals and pharmaceutical shares were the biggest drags. The yen strengthened slightly against the dollar following a three-day. 1.2 percent drop

The Asia benchmark has risen about 22 percent this year, outstripping the S&P 500 Index’s 12 percent advance to a record, as investors looked past tensions between the U.S. and North Korea. Further gains may lie ahead because the Fed is expected to leave rates unchanged and may use “slightly dovish†language when announcing its decision later Wednesday in Washington, said James Soutter, a fund manager at K2 Asset Management in Melbourne. “Lower for longer rates probably means the U.S. dollar remains weak,â€Soutter said in an email. That’s “a positive for Asian stocks.”

Elsewhere, the New Zealand dollar surged after a poll put the ruling National Party back in the lead ahead of the main opposition Labour Party ahead of this weekend’s election. And the fixing of the yuan remained in focus as investors try to gauge where the People’s Bank of China wants the currency. In a notable move in Chinese rates, the local 5Year bond yield had its biggest move since March.

What has changed? China 5 yr makes biggest jump since March pic.twitter.com/RZKz4gOBUp

— Sunchartist (@Sunchartist) September 20, 2017

Similarly, European equities are little changed for a second day, unwilling to make major moves ahead of any potential Fed surprises: the Stoxx Europe 600 Index was unchanged. Zara owner Inditex SA was among the worst performers after posting first-half earnings that missed analysts’ forecasts, while Kingfisher Plc was the best gainer after reporting France retail profit for the first half that beat the average analyst estimate.

In rates, the yield on 10-year Treasuries declined two basis points to 2.22 percent, the largest drop in almost two weeks. Germany’s 10-year yield fell two basis points to 0.44 percent, the biggest drop in almost two weeks. Britain’s 10-year yield declined less than one basis point to 1.327 percent.