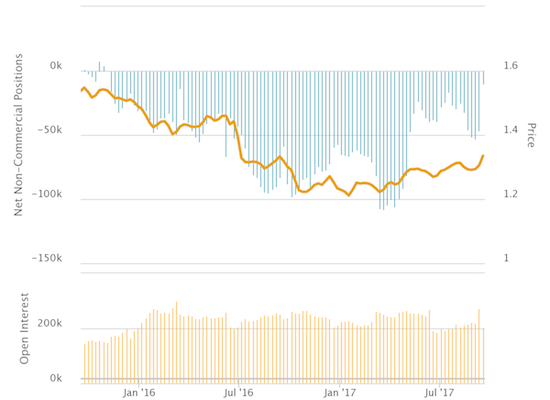

In one fell swoop, the Bank of England’s (BoE) hawkish posturing flushed shorts out of the British pound (FXB). The net short position of speculators has not been this low ever since the latest wave of currency bearishness began against the British pound.

Abandon shorts! Currency speculators quickly covered their shorts against the British pound.

Source: Oanda’s CFTC’s Commitments of Traders

This rapid closure of shorts helps explain the rapid burst of strength in the British pound in the wake of the BoE’s statement on monetary policy. While that week ended with another burst of strength, last week the pound failed to make much net incremental progress. This stasis means the coming week could prove pivotal in demonstrating whether the market is convinced that the BoE means business on future rate hikes. As I stated earlier, I am skeptical, but I have adjusted my trading strategy to the new momentum.

The British pound slowed down against the U.S. dollar last week as the Federal Reserve took center stage. GBP/USD churned for most of the week.

EUR/GBP stopped cold as it hovered above support at its 200-day moving average (DMA).

Source:Â FreeStockCharts.com

Â