European stocks rose as the euro tumbled following Germany’s election result which was dubbed a “Nightmare Victory” for Merkel and could lead to potentially complicated coalition talks and perhaps even another early election. U.S. equity-index futures point to a lower open, while Asian equities slide after a plunge in Chinese property developer names over worries of new real estate curbs as well as tech stocks following more iPhone delivery concerns. S&P500 futures are steady, down slightly by just over -0.1%, after closing little changed on Friday.

For those who missed it, in the main political event over the weekend, the German election results showed Chancellor Merkel set for a 4th term after her CDU/CSU won the most votes, but performed weaker than expected and will need to undertake coalition discussions. In terms of the number of seats, CDU/CSU won 246 seats, SPD won 153 seats, AfD won 94 seats, FDP won 80 seats, Die Linke won 69 seats and Grune won 67 seats. Given the abysmal performance of the SPD (worst performance since WW2), the party have efused to enter into a Grand Coalition and instead will form the opposition (to avoid AfD becoming the opposition). As such, Merkel will now have to try and form a ‘Jamaica’ Coalition with the FDP and Green parties. However, the FDP initially distanced themselves from forming such an alliance. Furthermore, according the CSU are reportedly considering their historical alliance with the CDU following yesterday’s result. Further reports suggest that the CSU are set to vote on their alliance with Merkel’s CDU, However, according to a report on Germany’s n-tv, CSU leader Seehofer said his party would remain a partner with Merkel’s CDU, although Seehofer said he wants CSU leadership to vote on joint caucus.

“The question is obviously now what it means for policy going forward†in Germany, Mitul Kotecha, head of Asia FX and rates strategy at Barclays Bank Plc, said on Bloomberg Television in reference to the election. “Investors are going to be closely following announcements on policy, especially given that fact that the AfD is not just nationalist, but also anti-euro to some extent.†As Bloomberg adds, the process of building a new government could take weeks, so markets may well move on from the result quickly.

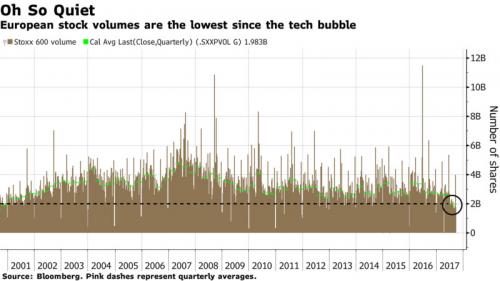

The Euro pushes lower through European trading as investors digested these political developments. German election fallout with smaller mandate for Merkel is coupled with latest Italian polls showing support for populist Five Star Movement. The resulting slide in the common currency, which saw the EURUSD slide below 1.189 this morning, sent European stocks modestly higher although the reaction was decided mixed among another session of near record low volumes as trader paralysis continues in a centrally-planned market.The Stoxx Europe 600 Index fell less than 0.1%, as losses in banks and miners offset gains in travel-and-leisure and media shares. Tullow Oil jumped 6.8% after saying Ghana’s new maritime boundary as determined by a tribunal doesn’t affect the TEN fields, and it expects to resume drilling around the end of the year.

Also over the weekend, New Zealand held its general election on Saturday which resulted to a hung parliament, as no party gained the 61 seats needed for a majority. In terms of the projected results, the incumbent National Party won 58 seats, main opposition Labour Party won 45 seats, New Zealand First won 9 seats, Green Party won 7 seats, ACT won 1 seat and the Maori Party won 0 seats. The result has been broad-based weakness for the Kiwi with the AUDNZD rising over 100 pips from its Friday close of 1.0860.

Separately, North Korea’s Foreign Minister stated that President Trump’s labelling of Kim Jong Un as ‘Rocketman’ has made North Korean rockets’ visit to entire US mainland inevitable, while there were also separate reports that US Air Force B-1B Lancer Bombers flew over the waters east of North Korea on Saturday.Elsewhere, on Monday Japan PM Abe confirmed recent rumors, and announced he would dissolve the lower house of parliament on September 28th, to call a snap election and further cement his power following the recent spike in popularity.

The yen pared a drop as Japan’s prime minister unveiled a fresh stimulus package and said he’ll dissolve the lower house of parliament ahead of a general election. Stocks in Europe edged higher helped by the weaker euro, but shares in developing nations headed for a third day retreating.

Asian equities fell, with the region’s benchmark set for a third day of declines from its highest level in almost a decade, as investors weighed the outlook for returns and political uncertainty prompted some to cash in some of the gains from this year’s rally. The MSCI Asia Pacific Index retreated 0.5% to 162.25 in Hong Kong as about three stocks declined for every two that gained. Japanese stocks advanced, with the Topix closing at a fresh two-year high, as the yen weakened against the dollar on speculation of fiscal stimulus by Abe. “Some investors have decided to take some of their gains from the table after the recent rally drove valuations up in many Asian markets,†said John Teja, a director at PT Ciptadana Sekuritas Asia in Jakarta. “The biggest risk for the region and global equities market in general remains the political risk on the Korean peninsula.†The Asian equities benchmark has surged about 20 percent so far this year, putting it on course for its best annual performance since 2009, underpinned by low interest rates and an improving outlook for earnings growth.

Of note, the Hang Seng Mainland Properties Index plunged more than 5% overnight, its biggest single day drop, after China introduced new curbs on real estate over the weekend. The move send the Hang Seng lower by 1.4%, its biggest drop in 6 weeks.

Also notable, China’s offshore Yuan tumbled to 6.6205 as China’s recent push to weaken the currency, including the weakest fixing since August 31, sent the CNH to the lowest level since August 28.

In rates, the yield on 10-year Treasuries fell one basis point to 2.24 percent, the lowest in a week. Germany’s 10-year yield declined four basis points to 0.41 percent. Britain’s 10-year yield fell one basis point to 1.341 percent, the largest drop in more than two weeks.

In commodities, gold fell 0.2 percent to $1,295.40 an ounce. West Texas Intermediate crude declined 0.1 percent to $50.63 a barrel, while Brent pushed to the highest level since February.

The week is full of Fed speakers, with Yellen set to discuss monetary policy on Tuesday, while the calendar sets off with Dudley, Evans and Kashkari taking the podium today. Investors will look for cues on monetary policy as Fed and ECB officials speak this week: “In the U.S., the mystery of the missing inflation will likely feature in a slate of Fed-speak, with core inflation stuck at 1.4%,” Societe Generale strategists including Stephen Gallagher wrote in note.