The top news on Tuesday was Yellen’s speech delivered to the National Association for Business Economics in Cleveland. The topic of conversation was how badly the Fed has miscalculated inflation. It’s surprising to see this coming up so soon after the Fed’s decision on rates because the Fed was hawkish and this was a dovish speech. At the same time, it’s also surprising that it took so long for the Fed to realize it made a mistake. The reason it took so long is because it’s a closely held belief among Fed officials that low unemployment means inflation is coming. They couldn’t change a belief like this until there was unrelenting evidence to go against it. The Fed saved face by admitting they were wrong after a better than expected inflation report.

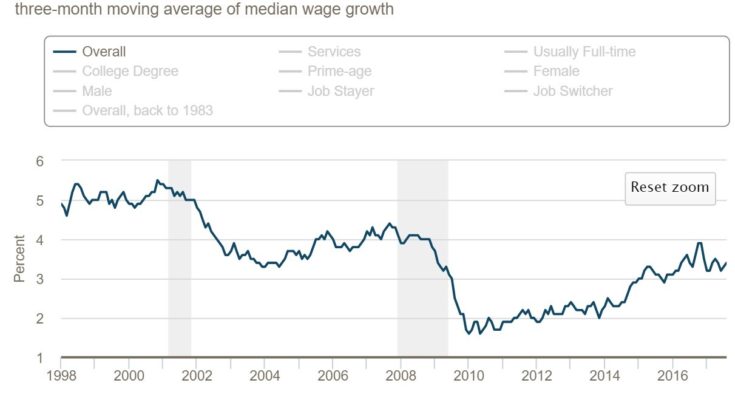

Specifically, Yellen said: “My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation.” The chart below is what Yellen is referring to. As you can see, after hitting 3.9% at the end of last year, the wage growth has fallen, stagnating in the mid 3% range. That’s about 1% lower than the last cycle peak which was about 1% below the previous cycle. At this pace, the next cycle might only see 2% wage growth. It’s important to see that the Fed’s miscalculation is massive because they don’t understand why there hasn’t been higher wage growth or inflation in the past 15 years.

(Click on image to enlarge)

The key point the Fed missed out on in the past 15 years is the influx of workers from Asia and eastern Europe. This caused labor to be outsourced, lowering wages for developed world workers. This demographic trend caused an increase in income inequality in America, but decreased inequality between America and the emerging markets. The chart below shows the hollowing out of the American labor force as the service industries now employ 86% of workers. This is while the manufacturing firms still make a majority of the profits. The trend of the workforce increasing appears to be stabilizing, but the next trend that needs to be weighed is robots taking jobs from Americans.