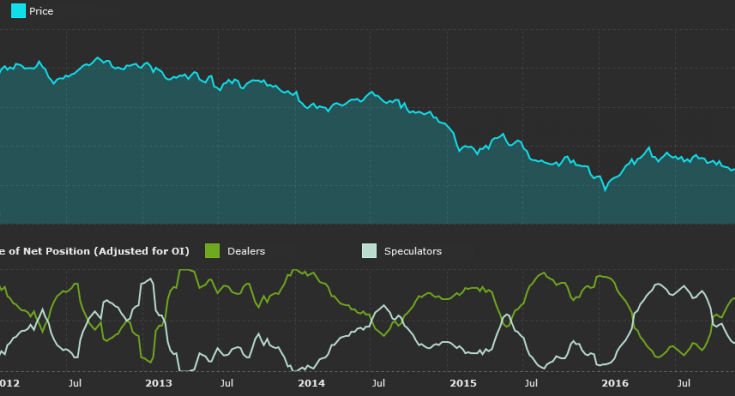

EUR/USD

(Click on image to enlarge)

Non-Commercials increased their net long positions in the Euro last week buying 25k contracts to take the total position to 88k contracts. Positioning adjustments in the single currency have been increasingly volatile over the last few weeks as traders have been adjusting their view in response to the ECB’s latest meeting, as well as various data releases and comments from ECB members. The recent strength of EUR has proved a point of concerns

The recent strength of EUR has proved a point of concerns form some ECB members due to the negative impact on net exports, but growth in the eurozone continues to improve. The results of the German elections created some mild volatility last week with the CDU failing to gain an absolute majority and the far-right AfD party gaining seats in the Bundestag for the first time. However, the reaction was fairly limited and focus now turns to a discussion on the likely coalition which will be formed.

GBP/USD

Non-Commercials reduced their net short positions in Sterling last week and flipped net-long, buying 15k contracts to take the total position to 5k contracts. The record GBP short position that began building in response to the June 2016 Brexit referendum has now finally been reversed as traders have shifted their view in response to better data out of the UK and a hawkish shift by the BOE.

At their latest meeting, the bank noted that a rate hike will likely be appropriate over the coming months if the economy continues to perform as expected. Focus this week will be on a raft of PMI data sets, with traders keen to see how growth has been affected by the start of the Brexit negotiation process following a downward revision to the Q2 figure.

USD/JPY

(Click on image to enlarge)

Non-Commercials increased their net short positions in the Japanese Yen last week selling 20k contracts to take the total position to -71k contracts. Last week’s adjustment was the largest week of selling in Japanese Yen since the summer as flow return to broader fundamentals and away from the tensions between North Korea and the US. At their recent meeting, the BOJ reaffirmed their commitment to continuing with their easing program which runs QQE along with a focus on keeping JGB yields at 0%. With nearly all of the G10 central banks having taken a hawkish shift, the policy divergence has kept focus on further downside for the Yen.