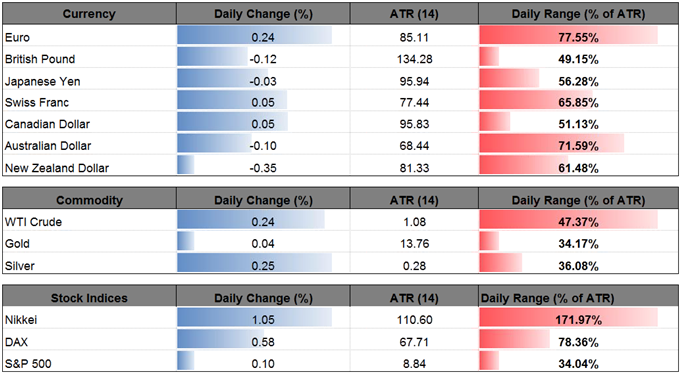

EUR/USD bounces back from a fresh weekly-low 1.1730, but the lack of momentum to snap the recent series of lower highs & lows raises the risk for a larger correction amid the mixed language coming out of the European Central Bank (ECB).

The ECB appears to be in no rush to remove the quantitative easing (QE) program as Governing Council member ChrystallaGeorghadji argues ‘only a sustained adjustment in the path of inflation would warrant the gradual withdrawal of our exceptional degree of monetary policy accommodation,’ while Peter Praet warns the asset-purchase program may run beyond the December deadline as ‘overall inflation developments, despite the solid growth, have remained subdued.’ The cautious remarks suggest the ECB will continue to utilize its balance sheet throughout the remainder of the year, and President Mario Draghi and Co. may ultimately reveal a more detailed exit strategy in 2018 as the central bank struggles to achieve its one and only mandate for price stability.

In turn, the ECB meeting minutes due out later this week may have a limited impact on the monthly opening range as the central bank attempts to buy more time and tames expectations for a material shift in monetary policy.

EUR/USD Daily Chart

- EUR/USD stands at risk for a larger correction following the failed run at the 1.2130 (50% retracement) hurdle, while both price and the Relative Strength Index (RSI) snap the bullish formations from earlier this year.

- May see the former-support zone around 1.1860 (161.8% expansion) now offer resistance, with a break/close below the 1.1670 (50% retracement) region opening up the next downside target around 1.1580 (100% expansion).

- However, failure to test the August-low (1.1662) may spur range-bound conditions ahead of the next ECB meeting on October 26.

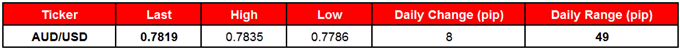

AUD/USD struggles to hold its ground following the Reserve Bank of Australia (RBA) meeting, with the pair at risk of extending the decline from earlier this month as the central bank appears to be on course to preserve the record-low cash rate throughout 2017.