Previous:

Yesterday, Tuesday, the euro/dollar rate closed slightly up. Buyers managed to induce a rebound from 1.1696 on the back of some positive data from the Eurozone coupled with negative UK statistics. On the back of a jump on the euro/pound cross from 0.8822 to 0.8881, the euro/dollar bulls managed to bring the price up to 1.1737. I’ll outline the current market situation below.

Day’s news (GMT+3):

- 10:55 Germany: Markit services PMI (Sep);

- 11:00 Eurozone: Markit services PMI (Sep);

- 11:30 UK: Markit services PMI (Sep);

- 12:00 Eurozone: retail sales (Aug);

- 15:15 USA: ADP employment change;

- 16:45 USA: Markit services PMI (Sep);

- 17:00 USA: ISM non-manufacturing PMI (Sep);

- 17:30 USA: EIA crude oil stocks change (29 Sep);

- 20:15 Eurozone: ECB President Draghi’s speech;

- 22:15 USA: Fed’s Yellen speech.

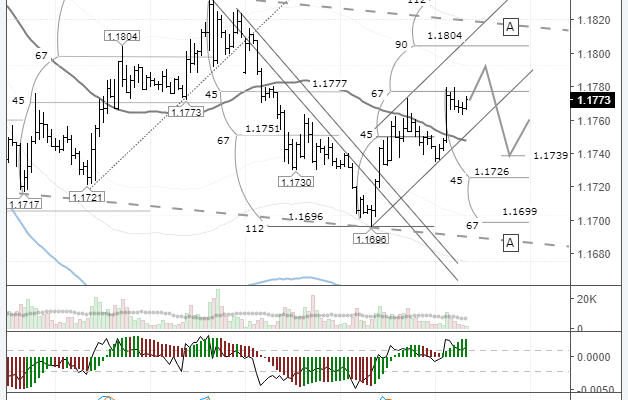

EUR/USD rate on the hourly. Source: TradingView

Yesterday’s session didn’t go as I expected. The British and European statistics changed the landscape. Firstly, the price restored from the D2 line or 112th degree to the balance line at 1.1763 (simple average line with a period of 55), then, following a pullback during the Asian session, growth continued to reach 1.1780.

A new daily high has been hit. This correction from the low of 1.1696 marks a 61.8% retracement of the downwards wave from 1.1832 to 1.1696. Given that the 61.8% Fibo level runs close to the 67th degree, this makes 1.1777 levels an important resistance.

The Stochastic has reversed downwards. The CCI is starting to reverse downwards and needs to close below +100. It seems that all the conditions for continuing the downwards trend on the pair have been fulfilled, but there are still some internal doubts.

One thing bothering me is that the rebound from the 67th degree was weak. Because of this, we need to keep an eye on the dynamics of the euro/pound cross and on US bond yields. Another thing is that in the US today, employment data from the ADP is set to be released as well as a non-manufacturing PMI from ISM. There are also going to be speeches from ECB head Mario Draghi and Fed chair Janet Yellen. They could be game changers.