Gold prices ended Monday’s session up $7.87, boosted by short covering in response to geopolitical concerns. The greenback came under renewed pressure as the euro gained strength on the back of the better-than-expected German data. XAU/USD is currently trading at $1285.18, slightly higher than the opening price of $1283.87.

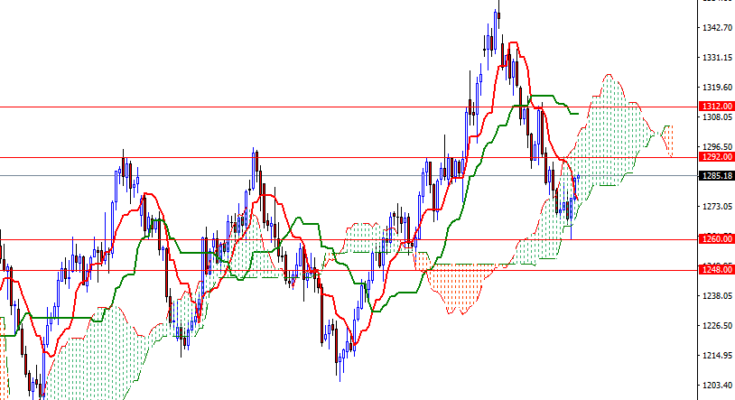

The market tested the 1282/1 area as support earlier in the Asian session and it appears that prices will attempt to penetrate the 4-hourly cloud. XAU/USD is trading above the Ichimoku clouds on the H1 and the M30 time frames; plus we have positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both charts. However, note that prices are still moving inside the daily cloud.

To the upside, the initial resistance sits at 1288, followed by 1292/0. If the market successfully penetrates the 4-hourly cloud and anchors somewhere beyond 1292, then look for further upside with 1298/6 and 1302 as next targets. The bottom of the cloud on the H4 chart stands at 1275 and the bears have to drag prices below that support to make an assault on 1270/68. Closing below 1268 on a daily basis opens up the risk of a drop to 1260.

Â