The Office for National Statistics on Monday said it made an error during the original calculations and that cost per unit output stood at an annual 2.4 percent in the second quarter, not the previously reported 1.6 percent.

Also, the first quarter number was revised up to 3.5 percent, the fastest in almost four years. Suggesting that price pressures are stronger than previously envisaged and likely to compel policymakers to raise interest rates faster than anticipated.

The inflation rate rose to 2.9 percent in August up from 2.6 percent in July, however, low new business investment in the manufacturing and construction sectors and mixed services sector numbers had held traders back as they believed weak fundamental numbers will weigh on the possibility of the Bank of England raising borrowing costs from 0.25 percent record-low. However, with the cost pressures now higher than the previous calculations, the apex bank may be forced to raise interest rates regardless of weak productivity. Hence, the reason Pound rose on Monday and during the Asian session on Tuesday.

Therefore, as the odds of the Bank of England raising rates surged so would the attractiveness of the Pound Sterling against its counterparts. Again, Brexit negotiation and comments from lawmakers may impact market reaction.

According to Howard Archer, a chief economic at the EY Item Club, the increase in labour cost numbers may force a November rate hike. Borrowing cost could increase from current 0.25 percent to 0.5 percent.

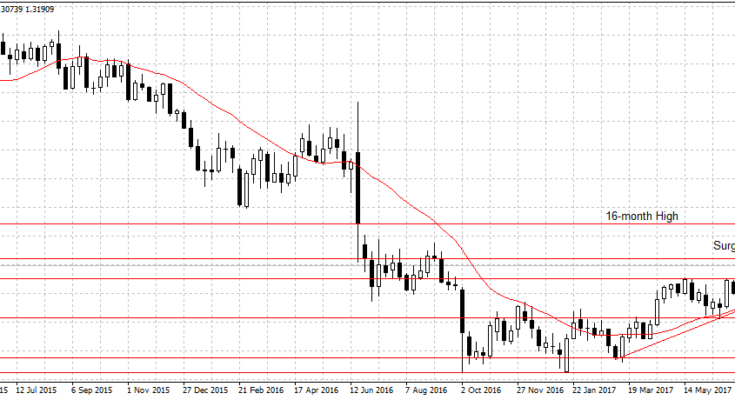

Also, this change will affect our GBPUSD bearish analysis. I will be standing aside to monitor market reaction amid Brexit negotiation.

Â

The pound gained 0.32 percent against the U.S. dollar to $1.3184 earlier this morning.