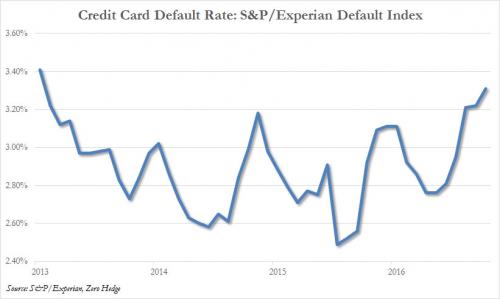

Four months ago, when looking at the latest S&P/Experian data, we first reported that credit card defaults had surged the most since June 2013, a troubling development which ran fully counter to the narrative that the economy was recovering and the US consumer’s balance sheet was improving.

The troubling deterioration prompted Moody’s to open its own report titled “Spike in Charge-off Rates Indicates a Slide in Underwriting Standards” and as Moody’s analyst Warren Kornfeld wrote, the steep increase in credit card charge-off rates in 1Q’17 and 4Q’16 was the largest since 2009, and indicates that “strong underwriting standards in place since the financial crisis have deteriorated, potentially rapidly.”

Then, following JPM’s results earlier today, we showed that this concerning trend had persisted, with JPM reporting the second highest net credit card charge-offs in Q3 since the summer of 2013, and only a modest decline since the previous quarter.

It wasn’t just the charge-offs however: there was another red flag in JPM’s results this morning in addition to the sharp 27% drop in the bank’s FICC revenues: with charge-offs spiking, it was only a matter of time before both JPM and its peers was forced to provision substantially greater credit losses ahead of potential pain in the future, and as we showed first thing this morning, JPM did just that when it hiked its credit loss provision from $1.2 billion in Q2 to $1.45 billion in Q3.

This negative development was not lost on the broader investor and analyst community, either, and as Bloomberg reports, after enjoying years of declining losses from fewer consumers defaulting on debts, banks “appear to be preparing for a turn.” And it wasn’t just JPMorgan either, as both JPM and Citi “just boosted their reserves for consumer-loan losses by the most in more than four years” as “Both lenders set aside money in the third quarter because they expected write-offs for credit-card lending to climb in periods ahead, with Citigroup saying the increase is coming faster than it had anticipated.” Ominously, Bloomberg picked up on what we said in June, noting that “the initial reports from JPMorgan and Citigroup signaled a shift in consumer credit quality.”