Data/Event Risks

Data/Event Risks

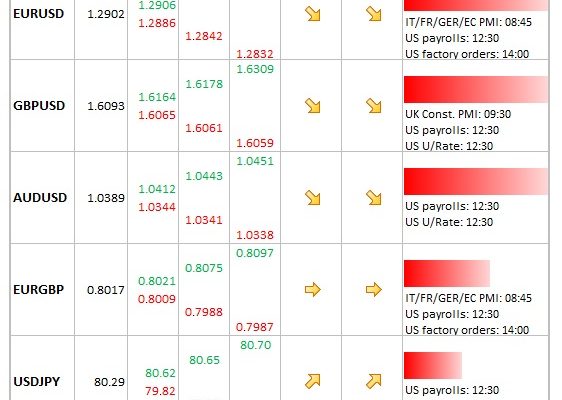

- USD: Payrolls is the main focus today – market expects a 125K increase. Traders seem positioned neutral for this one, so will need a big deviation from consensus to move the dial on the dollar.

- EUR: Prior to payrolls, the manufacturing PMIs for Europe’s big economic heavyweights are released. All are expected to remain well below 50.

- GBP: The construction PMI carries some weight in the UK – if above 50 today then this should assist sterling.

Idea of the Day

Yen weakness against the majors remains one of our preferred strategies. As last night’s BoJ Minutes revealed, the Japanese economy may well be falling back into recession. Also, dollar index seems finally to have broken the 80 level – watch closely, it is entirely possible that we see an impulsive move to the topside soon.

Latest FX News

- USD: For the dollar, yesterday’s labour market news hardly made an impact. Jobless claims fell 9K to 363K while ADP private payrolls rose 158K. Taken together, these figures imply that today’s payrolls outcome will merely confirm that jobs growth remains pedestrian. USD index now comfortably through the 80 level after overnight euro weakness.  Â

- EUR: Unable to crack above 1.30, traders turned around and decided to test the downside once again. As well, late yesterday and overnight there was some determined selling by European names. How deep are those buyers below 1.29? We shall see today.

- JPY: Of interest is that recent yen weakness has occurred against the backdrop of Asian currency strength. Japan’s corporate demise is clearly weighing on the currency, and investors who want Asian exposure are heading to the mainland, as are those who sought the yen as a safe-haven.

- AUD: Managed to get up above 1.04 after decent US ISM outcome and a 3yr high for consumer confidence. Recent improvement in Chinese growth figures seems to have removed significant downside risk, for now. Still seems likely that the RBA will lower rates again next week.