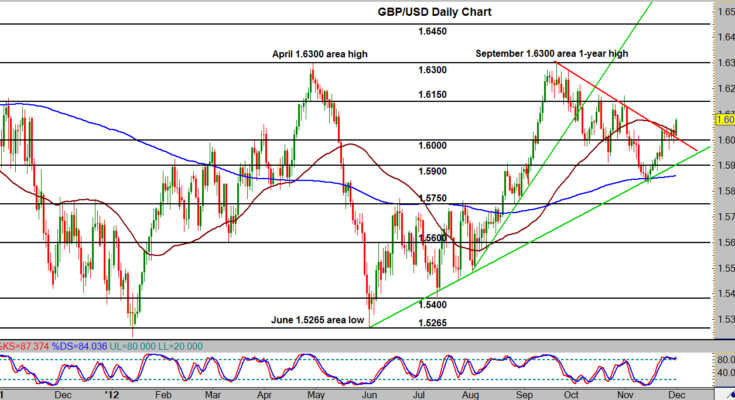

GBP/USD (daily chart) has continued to maintain its bullish stance by making a significant advance after having had daily closes above the important 1.6000 level for the entire past week. This substantial move to the upside occurs after price broke out above several resistance levels, including the 1.6000 level, the 50-day moving average, and an important downtrend resistance line extending back to the September 1.6300 area high. This all occurs within the context of a well-established uptrend extending back to the June 1.5265 area low. With potential nearby resistance residing around the key 1.6150 level, any further upside momentum that breaks out above that level could move towards yet another re-test of the 1.6300 resistance region, first established in April and re-tested for the first time in September. To the downside, the key 1.6000 level continues to serve as potential support within the context of the longer-term bullish trend.

James Chen, CMT

Chief Technical Strategist

FX Solutions

Forex trading involves a substantial risk of loss and is not suitable for all investors. FX Solutions LLC (“FXSâ€) is compensated through a portion of the bid/ask spread. This information is being provided only for general market commentary (based on technical analysis) and does not constitute investment trading advice.  Certain information contained herein has been obtained from sources that FXS believes to be reliable; however, FXS cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is subject to change without notice. FXS has no obligation to update any or all of such information; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision. Past performance is not necessarily indicative of future results. No determination has been made regarding the appropriateness of any information contained herein. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated herein. FXS expressly disclaims any loss or profits that may arise from any use of the information contained in or derived from this commentary. FXS and its affiliates may engage in transactions that are inconsistent with the views expressed herein. FXS does not endorse nor is it responsible for any third-party posts related to this material.