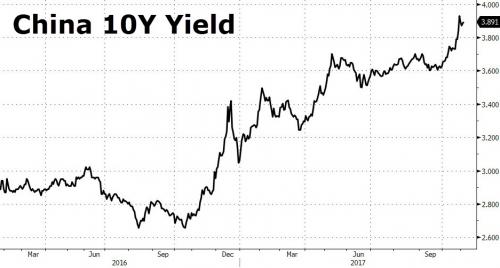

During the Party Congress, even China’s somewhat watered down versus of the free markets was suspended so as not to disturb the glorification of Xi Jinping as the nation’s greatest leader since Mao. Returning to “business as usualâ€, some commentators have been disturbed by the continued rise in government bond yields with the 10-year hitting 3.93% earlier this week.

Bloomberg described it this morning as a “tumultuous few daysâ€.

We also noted Huachuang Securities Co. comment that bond holders may be about to get hit by “daggers falling from the sky,†if the Party adopts more aggressive deleveraging policies. In a far less sensationalist way, the Wall Street Journal has attempted a post-mortem on the recent sell-off in the Chinese government bond market.

Catching sight of a chain reaction in China’s markets is rare.

Carrying out a postmortem of a recent selloff in China’s $9 trillion bond market shows how it is becoming harder for Beijing to untangle its increasingly intertwined financial system. In the aftermath of China’s twice-a-decade party congress last week, yields on benchmark 10-year Chinese government bonds spiked to 3.9%, their highest in three years. Government bond futures fell.

Reasons proffered for the sudden rout ranged from expectations of higher U.S. interest rates to general fearmongering.

Having acknowledged the growing complexity of China’s financial system, WSJ provides a valuable insight, noting the relative stability of corporate bond yields during the recent sell-off in the government sector…

An important anomaly to note about the bond rout: as government bonds sold off, yields on less-liquid, unsecured Chinese corporate bonds barely moved.

That is atypical in an environment of rising rates – usually, bond investors shed their less-liquid holdings and hold on to assets that are more easily tradable, like government debt.

Using this handy (kind of) diagram of flows in China’s financial system…