Data/Event Risks

Data/Event Risks

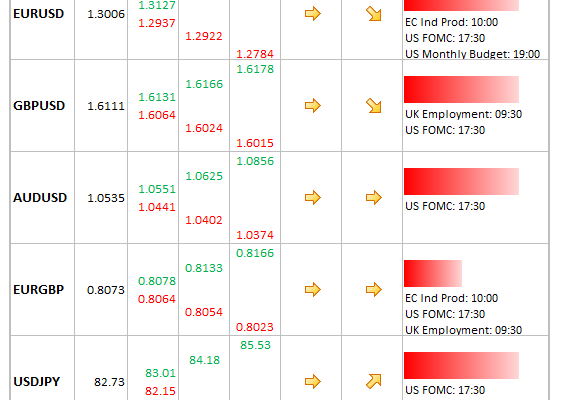

- EUR: Other than industrial production at 10:00, not much else to get excited about. Fresh rumours of Spain asking for financial assistance soon. Also, Greek debt buyback raised less than expected, which will attract the ire of the IMF.

- GBP: Labour market data awaits – is there a whiff of slower jobs growth in the air? Overall, 2012 has been a remarkably decent year for employment.  B0E Chief Economist, Dale, speaks later in the morning; unlikely to be market-moving.

- USD: Expect yet another sizeable Fed program of asset purchases when the FOMC makes its announcement at 17:30. Yesterday there did appear to be some shorts set up ahead of the decision.

Idea of the Day

A remarkably sanguine disposition was evident in currency markets yesterday, with the dollar softening against other majors except for the yen. Especially impressive is the Aussie, which just continues to creep higher. Traders and investors still want to believe that a fiscal cliff deal will be done soon, but if the rhetoric turns ugly again then the mood will darken and the dollar will benefit. One way to approach the major currencies therefore is to fade the extremes.

Latest FX News

- EUR: Was well bid again yesterday despite an absence of obvious triggers. Perhaps speculation that Monti might be convinced to seek election as PM helped at the margin. German ZEW was also slightly better than expected. Has crept above 1.30 without too much fuss, which will encourage the bulls.

- GBP: Underperformed the euro yesterday, but against the dollar still looked OK, with cable now through 1.61.

- CHF: Weakened after UBS announcement that it would charge customers holding Swiss franc balances. SNB would no doubt be pleased to see EUR/CHF above 1.21.

- AUD: Retains a healthy glow, now comfortably above the 1.05 level which recently had been resisted. Ignored soft consumer confidence figures overnight. No need to fight that tape – has been heading gradually higher for the past two months – and 1.06 likely to be tested before long.