EUR/USD

Non-Commercials reduced their net long positions in the Euro last week selling 11.4k contracts to take the total. The key driver for EUR flows this week is likely to be the development of US tax plans as the market looks to gauge the likelihood of the Senate approving Trump’s proposed reforms. Alongside this, traders will also be paying attention to the selection of a new Fed chairman as the prospect of a hawk gaining control would likely weigh on EUR.  On the data front, the Euro schedule is relatively light this week with German factory orders in Industrial Production the only key readings.

GBP/USD

Non-Commercials increased their net long positions in Sterling last week buying 1.2k contracts to take the total position to 64.5k contracts. Upside exposure had been building over recent months as traders reacted the BOE’s increasingly hawkish guidance. The bank raised rates by a quarter of a percent last week, however, the market reaction seems to have neglected the more hawkish elements. The continuing fluctuations in the UK political environment will likely be the main driver of GBP this week. However, the re-pricing in short-term rates should keep GBP underpinned. On the data front this week, the only key reading is Industrial Production due on Friday which is forecast to have increased over September.

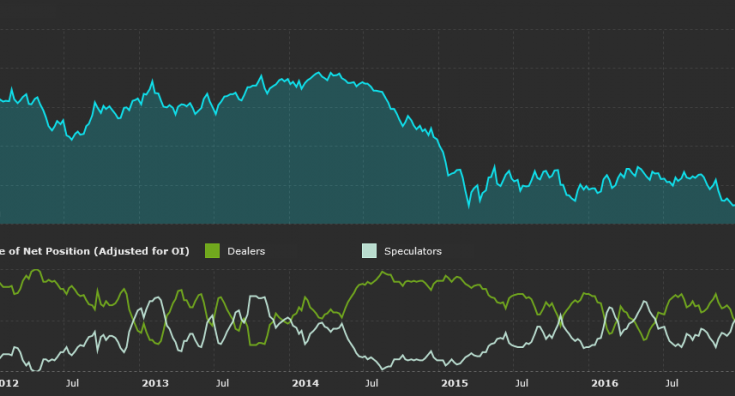

USD/JPY

Non-Commercials increased their net short positions in the Japanese Yen last week selling a further 2k contracts to take the total position to -119k contracts. JPY flows continued to be mainly linked to broader USD themes as well as fluctuations in global risk appetite. This week, Trump is due to meet with PM Abe during his Asia trip. The focus will likely be on any comments regarding the ongoing nuclear threat from North Korea. Traders will also be watching for the BOJ’s release of the summary of its opinions at the bank’s 30-31st meeting. On the data front, this week traders will be watching machinery orders for September as well as forecasts for Q4.