EURUSD Daily Pivots

| R3 | 1.1036 |

| R2 | 1.0927 |

| R1 | 1.0843 |

| Pivot | 1.0733 |

| S1 | 1.065 |

| S2 | 1.0539 |

| S3 | 1.0457 |

EURUSD made a fresh weekly high towards 1.08 levels late yesterday. This price action is indicative of a possible correction to the downside, with the first test coming in at support at 1.0693, which was only briefly tested. From there on, price could turn a bit tricky as the bias could quickly change, albeit price still remaining in the upward price channel. A break above the recent high is required to see further upside continuation, but we suspect this to happen only after a test to support.

USDJPY Daily Pivots

| R3 | 120.067 |

| R2 | 119.771 |

| R1 | 119.392 |

| Pivot | 119.09 |

| S1 | 118.771 |

| S2 | 118.414 |

| S3 | 118.035 |

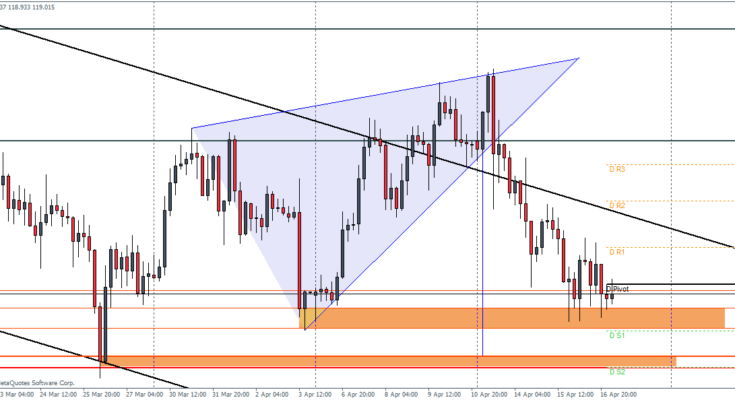

USDJPY has been constantly been rejected near the support zone at 118.9 levels and 118.737. A break below this will see a test to 118.5. Price action is currently consolidating near this support level and could seem hard to break down below. Nonetheless, the entire price region fro 119.045 through 118.5 looks hard to break and price could at the very least range before establishing direction.

GBPUSD Daily Pivots

| R3 | 1.5156 |

| R2 | 1.5063 |

| R1 | 1.4998 |

| Pivot | 1.4905 |

| S1 | 1.4839 |

| S2 | 1.47477 |

| S3 | 1.4683 |

GBPUSD rally saw a test of 1.495 highs. Price has been consolidating at this level for a few candles. We notice a missed test of support at 1.48 levels, which is where price could eventually head to. A break of the recent highs at 1.495, if it happens could be viewed as a weak rally and could make way for an eventual decline. The test to 1.48 could also mean a breakout from the rising price channel, which could potentially put GBPUSD back into bear territory.