EURUSD Daily Pivots

| R3 | 1.1405 |

| R2 | 1.1313 |

| R1 | 1.1249 |

| Pivot | 1.1157 |

| S1 | 1.1091 |

| S2 | 1.0999 |

| S3 | 1.0935 |

EURUSD broke below 1.117 level yesterday but quickly recouped its losses to rally back above 1.117. Price action has now formed a bullish flag pattern, which shows a potential move to the upside to 1.13575 and eventually to 1.149. A retest to 1.11705 cannot be ruled out however. A break below this level will see the currency turn bearish in the short term with a correction likely to 1.10. Within the larger scope, there also looks to be a double bottom in place near 1.05396 with the resistance at 1.10052 through 1.10034. This pattern gives a target to 1.13. We expect price to rally to 1.13 while the bullish flag’s target to 1.149 is likely to take a while longer.

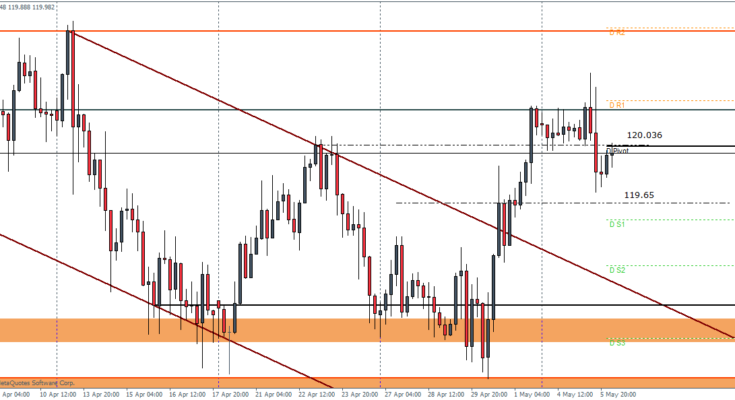

USDJPY Daily Pivots

| R3 | 121.103 |

| R2 | 120.803 |

| R1 | 120.323 |

| Pivot | 120.023 |

| S1 | 119.543 |

| S2 | 119.243 |

| S3 | 118.763 |

USDJPY has been ranging near 120.26 and 120.036. A break above 120.26 is essential in order to see more gains towards 120.73 levels. However, is resistance at 120.036 through 120.26 holds, USDJPY could yet again decline towards 119.65, the break out from the falling price channel.

GBPUSD Daily Pivots

| R3 | 1.5365 |

| R2 | 1.5291 |

| R1 | 1.5235 |

| Pivot | 1.5161 |

| S1 | 1.5107 |

| S2 | 1.5033 |

| S3 | 1.4977 |

GBPUSD has been trading between 1.51225 and 1.52 for the past few sessions. There is a pending retest near 1.528, which could be achieved if price action heads higher. In the near term, GBPUSD looks poised to the downside with the immediate supports at 1.5 and 1.495 levels. A break below these levels will see a test to 1.4724 and 1.463.