Data/Event Risks

Data/Event Risks

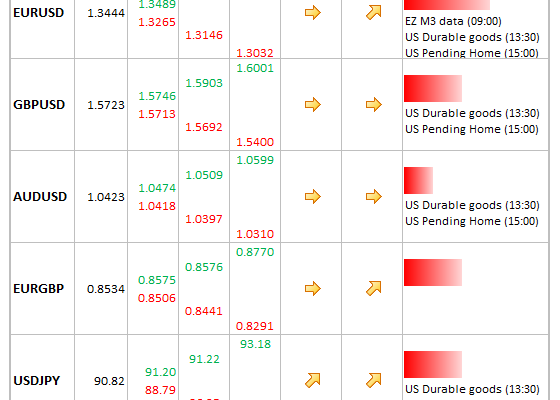

- USD: The data is of only modest risk to the dollar today in the form of pending home sales and durable goods, although the latter can be very volatile and could add to dollar strength if notably firmer vs. expectations.

- EUR: M3 data from the ECB rarely dents the currency, but of interest for what it tells us about lending in the euro area. Euro direction will be more dependent on whether resilient tone of last week is maintained and attracts further buying interest.

Idea of the Day

Friday was a strong example of the new world order in FX, something which we have written about for quite a while (see “From RORO to MOROâ€). You would have struggled to find a day when the yen was joined by the CAD and AUD as the weakest performers vs. the USD. At the same time, the euro was resurgent, having broken out of the established 2-week range. What was noticeable was the fact that sterling recovered the post-GDP losses, indicative of short-covering into the weekend. Meanwhile, the yen was nearly a one-way street, USDJPY breaking above 91 on USDJPY. The pull-back seen in the Asian session overnight means that USDJPY remains just beneath the top of the bull channel drawn from the middle of November. All in all, FX has become a lot more interesting in the past few weeks.

Latest FX News

- JPY:  USDJPY softer overnight and so far the top of the bull channel from mid-November on USDJPY remains intact on a closing basis (in contrast to EURJPY). PM Abe is predicting tax revenues higher than bond sales revenue for the first time in 4 years in the upcoming tax year.

- EUR:  Friday’s trading was significant for the fact that EURUSD broke above the range that has dominated for the past two weeks. It was just the euro and Swiss franc that managed to outperform the dollar last week. EURJPY made another high at 122.91 in early Asia trade, but has since pulled back to the 122 area.

- GBP:  In contrast to the yen, there was some short-covering on Friday, especially after the GDP-inspired dip, GBPUSD recovering all the early losses by early Friday afternoon. Latest house price data from Hometrack overnight showed prices flat on the month, with cable back near the post-GDP lows around 1.5750.

- Gold: Closing below the 200d moving average (1,663) on Friday, making 3 sessions of consecutive losses. The stronger start to risk sentiment for the early part of the year has undermined gold, so for now it could struggle to recover back above this key marker.

Further reading:Â EUR Could Enjoy USD Index Weakness (Elliott Wave Analysis)