This wasn’t hard to see coming. The Nikkei had fallen for four consecutive sessions and was flat on Tuesday, European shares had fallen for six straight days and the Stoxx 600 was sitting a seven-week low. Oil plunged yesterday. A bond selloff was brewing in China. And junk bonds were snapping.

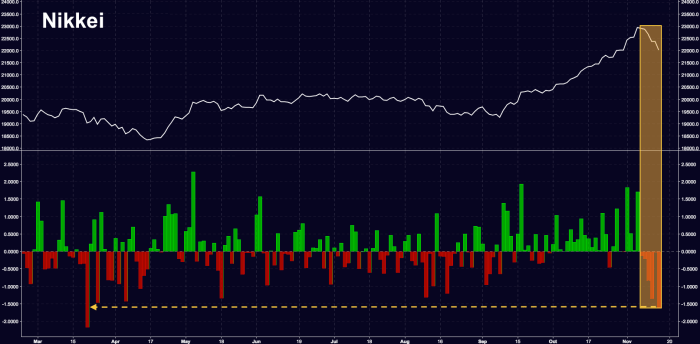

So yeah, the stage was set for a global selloff and we got it on Wednesday. The Nikkei fell for a sixth day, tumbling the most since March:

The Topix fell for a fifth day, its longest streak of the year.

In China, the bond selloff abated as the PBoC injected a net 220 billion yuan ($33 billion) in OMOs, but Chinese equities were not immune to the global risk-off sentiment. One day after weaker-than-expected econ, Chinese stocks tumbled across the board. The SHCOMP fell for a second day, taking the two-day slide to 1.3%:

Hong Kong shares fell the most in nearly a month:

Obviously, one of the big problems here is commodities. Crude is down sharply from where we were on Tuesday prior to the IEA report and more generally, commodity prices are in a dive.

“Commodity prices are sinking on rate-hike expectations as well as China data that missed some analyst forecasts,†Hao Hong, Hong Kong-based chief strategist at Bocom International Holdings Co, tells Bloomberg. “Investors are taking profits after rallies.â€Â

Right. And it’s classic risk-off. Treasuries are bid and so is gold:

Same thing in Europe. Everything is red.

So strap in – Dow futs are tipping triple-digit declines and the S&P’s best streak without a 0.5% decline since 1965 is on the line…

Â