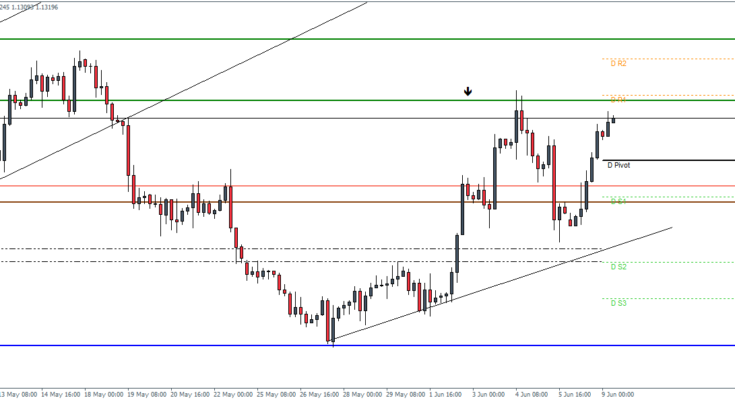

EURUSD Daily Pivots

| R3 | 1.159 |

| R2 | 1.1448 |

| R1 | 1.1368 |

| Pivot | 1.1225 |

| S1 | 1.1146 |

| S2 | 1.1003 |

| S3 | 1.0923 |

EURUSD (1.1099): EURUSD saw a rather choppy trading session yesterday but prices managed to hold above the 1.10 support level. Price action eventually managed to break free above 1.117 which briefly acted as resistance and is now currently a few pips short of the 1.13575 level of resistance A break above 1.13575 is needed to see EURUSD look for further gains towards 1.149 – 1.15 level of resistance.

USDJPY Daily Pivots

| R3 | 126.724 |

| R2 | 126.201 |

| R1 | 125.345 |

| Pivot | 124.820 |

| S1 | 123.955 |

| S2 | 123.43 |

| S3 | 122.565 |

USDJPY (125.472): USDJPY attempted a rally above 125.5 but failed to break higher, which resulted in a prompt decline back to the break out region of the triangle pattern. If this retest is successful, USDJPY needs to break above 124.8 in order to post higher gains. Failing to do so could see USDJPY test the major support at 124. Current price action also shows the possibility of a test to the longer term trend line which should help in holding the current declines. A break of this trend line however could put the bullish bias to test with 124 support likely to turn crucial.

GBPUSD Daily Pivots

| R3 | 1.5543 |

| R2 | 1.5453 |

| R1 | 1.5401 |

| Pivot | 1.531 |

| S1 | 1.5258 |

| S2 | 1.5168 |

| S3 | 1.5115 |

GBPUSD (1.5266): GBPUSD has managed to keep up its bullish momentum after bouncing off the 1.52 – 1.519 support level. But with price still trading within the falling price channel, we could expect to see a break of the upper trend line of this channel. To the upside, the resistance at 1.545 is starting to look increasingly possible for a test of resistance. However, price needs to break above the current 1.535 region and potentially retest this level in order to target 1.545 – 1.55.

In this week’s podcast, we explain why EUR rallied on Draghi, what’s next, discuss oil and gas, run through the Plus500 story and preview next week’s events.

Follow us on Stitcher