EURUSD Daily Pivots

| R3 | 1.148 |

| R2 | 1.1406 |

| R1 | 1.133 |

| Pivot | 1.1255 |

| S1 | 1.1181 |

| S2 | 1.1105 |

| S3 | 1.1029 |

EURUSD (1.1256): EURUSD continues to struggle to break free above the 1.12845 level of resistance with yesterday’s candlestick close below this level on a bearish note. The intraday charts shows price action is currently trading near the lower rail of the ascending price channel. It is critical that price holds above the lower rail here, failing which, we could see a quick decline to retest the 1.117 level of support. To the upside, EURUSD needs to break above 1.1335 – 1.13575 level of resistance to post new gains with the next target coming in at the resistance of 1.149.

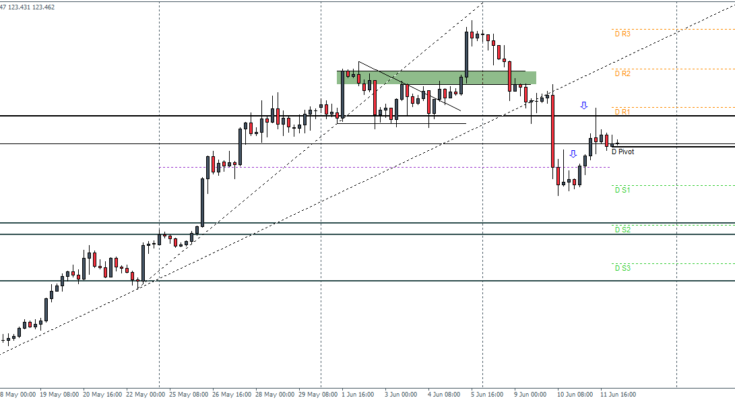

USDJPY Daily Pivots

| R3 | 125.686 |

| R2 | 124.912 |

| R1 | 124.165 |

| Pivot | 123.391 |

| S1 | 122.644 |

| S2 | 121.87 |

| S3 | 121.123 |

USDJPY (123.47): USDJPY attempted a bullish run yesterday but remained within the range of the previous day’s high and low forming an inside bar. A break out from here could likely see momentum build into the USDJPY. On the intraday charts, we notice a brief test back to 124 level of resistance but only by a spike. We could therefore expect a cleaner close at this level. A break below the previous lows of 122.65 will however see USDJPY fall below to test the lower support near 121.921.

GBPUSD Daily Pivots

| R3 | 1.5672 |

| R2 | 1.5602 |

| R1 | 1.5559 |

| Pivot | 1.549 |

| S1 | 1.5446 |

| S2 | 1.5377 |

| S3 | 1.5334 |

GBPUSD (1.551): GBPUSD formed a pinbar yesterday near the daily chart resistance of 1.552. On the intraday charts, price action is trading inside the resistance zone of 1.5455 through 1.552. We need to see a break above 1.552 in order for the Cable to target the next resistance level which comes in at 1.579. Alternatively, there is a risk of a decline to the downside to test the break out from the falling price channel towards 1.53845. A retest to this price level will then pave way for a potential break of resistance (1.552 – 1.5455) and set the stage for further gains to 1.579.

In our latest podcast, we bring you up to speed with the Fed decision and the USD impact, and also tackle the Greek crisis from two different angles.

Follow us on Stitcher