It’s 2018 forecast time for the big banks. With Goldman unveiling its seven Top Trades for 2018 earlier, overnight it was also UBS’ turn to reveal its price targets for the S&P in the coming year, and not surprisingly, the largest Swiss bank was extremely bullish, so much so in fact that its base case is roughly where Goldman expects the S&P to be some time in the 2020s (at least until David Kostin revises his price forecast shortly).

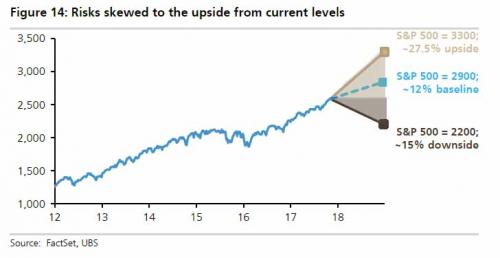

So what does UBS expect? The bank’s S&P “base case” is 2900, and notes that its upside target of 3,300 assumes a tax cut is passed, while its downside forecast of 2,200 assumes Fed hikes in the face of slowing growth:

We target 2900 for the S&P 500 at 2018 YE, based on EPS of $141 (+8%) and modest P/E expansion to 20.6x.

Our upside case of S&P 500 at 3300 assumes EPS gets a further 10% boost driven by a 25% tax rate (+6.5%), repatriation (+2%) and a GDP lift (+1.6%), while the P/E rises by 1.0x. Downside of 2200 assumes the Fed hikes as growth slows, the P/E contracts by 3x and EPS falls 3%. Congress is motivated to act before midterm elections while the Fed usually reacts to slower growth; so we think our upside case is more likely.

(Click on image to enlarge)

Â

Why is UBS’ base case so much higher than what most other banks forecast? According to strategist Keith Parker, the reason is a “Valuation disconnect”: Higher rates are priced in, while higher expected growth is not. He explains:

We model the S&P 500 P/E based on select macro drivers. The S&P P/E is 5x below the model implied level, which points to solid returns. More specifically, the 2.8% Fed rate target is priced in (worth 1.3x) but higher analyst expected 3-5yr growth is not (worth 3.7x). The P/E has been 2-4x above the implied level at the end of each bull market and the model has been a good signal for forward S&P returns (20-25% correlation). High-growth (most expensive) and deep-value (cheapest) stocks are cheap on a relative basis; the price for perceived safety is high. We focus on risk-adjusted growth + yield.