One way to predict the future is to accurately compute the direction of future inflation. This is because the direction of inflation is a big driver of financial asset prices. Following the exhaustion of the ‘Trump trade’ in the first quarter of this year, headline inflation has been falling in rate-of-change terms. During this time, the US dollar has substantially weakened while long-dated US government bonds have traded sideways. In the past few months headline inflation appears to have turned a corner, while the dollar has also been strengthening. Looking at reliable front-runners of inflation such as the copper/gold ratio, crude oil prices and 5y5y breakeven rates suggest that inflation is set to continue strengthening.

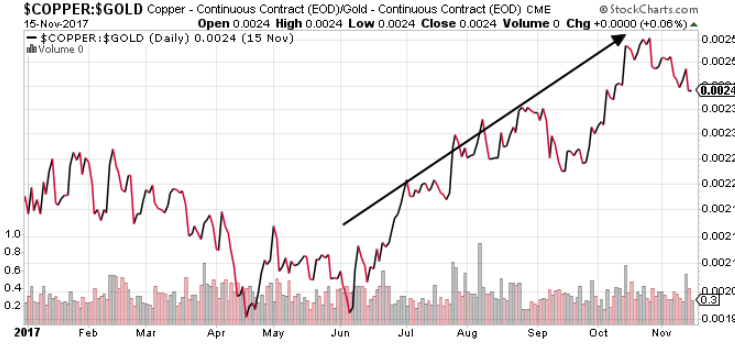

Copper to gold ratio suggests inflation set to accelerate

Favored by bond investor Jeff Gundlach, the copper to gold ratio is widely seen as a reliable indicator of future inflation. Copper is an industrial metal, and has many applications including power transmission, automobile manufacturing, and telecommunications. Thanks to accelerating GDP growth in China, Japan, the US and the European Union this year, copper prices have strengthened. On the other hand, gold tends to trade sideways or weaken when economic growth is strong. Unlike copper, gold has few industrial applications and is primarily used as a store of value. During an economic boom, investors sell gold in favor of assets such as stocks and corporate credit. As such, the trending direction of the copper/gold ratio is a good front-runner for inflation and is shown below for reference:

Up and up: Copper/gold ratio suggests a positive outlook for inflation

As can be seen from the chart above, the falling copper/gold ratio after March accurately predicted the demise of the ‘Trump trade’. Since June the ratio has been trending higher, suggesting that higher inflation is in store.

Strengthening crude oil another reason to get long inflation