Today’s release of third quarter GDP estimates should stay the hand of the Bank of Canada. Following a strong first half of the year, the Canadian economy slowed dramatically to an annual rate of 1.7 % in the third quarter compared to 4.3% recorded in the second quarter.

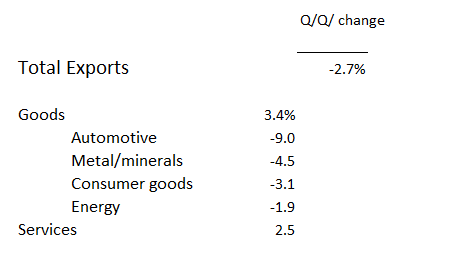

Most importantly, the composition of third quarter growth reveals a real split between the domestic and the international sectors of the Canadian economy. Household consumption grew by 1% and was the major contributor to overall growth. The real culprit was the very disappointing results from the export sector. All major export sub-sectors declined in the quarter, lead by the automotive sector which was down 9%, followed by metal/mineral exports down by 4.5% and then energy by 1.9%. Since Canada relies upon the external sector to generate as much as 25% of total income, the slump in exports does not bode well for the fourth quarter.

Canadian Exports Growth Third Quarter 2017

On the investment side, business fixed capital investment slowed to 0.4% and investment in residential structures actually fell by 0.4% for the second consecutive quarter.Â

The Bank of Canada has placed a lot emphasis on export growth and new investment to pull the Canadian economy forward. Interest rate increases are predicated on incoming data that must demonstrate that growth is “broad-based and sustainableâ€. These third quarter results indicate that the economy is far from robust. The weakness in exports came at a time when the Canadian dollar was depreciating and this should have boosted demand for Canadian manufactured products. Capital investment is being held back, in some measure, because of the uncertainty surrounding the NAFTA negotiations. Housing construction is slowing of its own accord in the wake of Ontario’s new, tougher, regulations governing mortgage lending.

The Bank of Canada raised its overnight rate by ¼% in July and again by the same amount in September. Given that interest rates hikes take several months to be fully effective, we can anticipate continued weak growth in the fourth quarter and possibly beyond into 2018. These rate hikes will most likely be felt in the household sector which is already of the most indebted in the G-20 nations. Those who are anticipating interest rates hikes will have to wait until there is more proof positive that this economy is performing well enough to absorb higher interest costs. So far, that evidence is not there.