Today, markets are waiting the all-important NFP release. A strong reading could stimulate the Fed to raise rates in its upcoming meeting. In this case, the USD is likely to rise sharply against major currencies, particularly the EUR which is the weakest, since Draghi announced he is open for more QE if required.

Technically speaking, we are tracking two counts on the USD Index, prepared on different short-term scenarios, but both are bullish for mid-term direction. On the first count, I am looking straight up into wave (v) towards the 97.00 area. If it breaks today, with a daily close price around it, then this will be a strong indication for more USD gains next week.

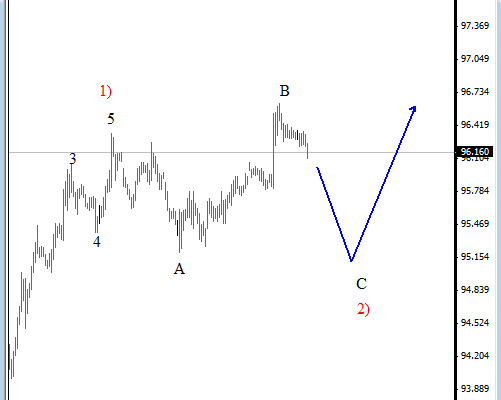

On the second count, I am looking at the flat in wave (2), which could come in play if the NFP data disappoints, which will likely be bearish for the buck, but not for long. On that count, we assume that the price will find a support around 95.00, early next week.

USD Index 1h- Elliott Wave Analysis #count 1

USD Index 1h- Elliott Wave Analysis #count 2