A decline from 125.82 occurs in three waves and three minor sub waves in A, so we think that the pair is in a big downward corrective retracement. Ideally, that is a flat with an extended wave C to the 116 area, where it might already accomplished wave (4), so traders should not be surprised by a move back to the highs by the end of the year.

USDJPY, Daily

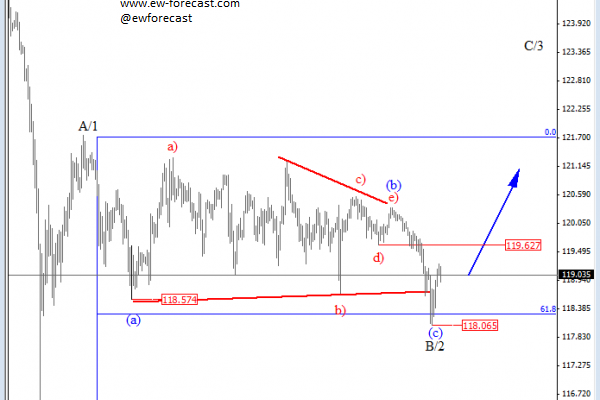

On the 4h chart, USDJPY fell sharply 48 hours back through the 118.57 level. Therefore it seems that a triangle that we have been tracking over the last few weeks was only in wave (b) of an incomplete black wave B/2 of a higher degree, that hit the 61.8% Fibonacci level. The price action is already turning up from there so ideally, the pair will turn back to a bullish mode now. An overlap with 119.62 will confirm a new impulse up for wave C/3, above 121.70.

USDJPY, 4h