After looking across the different markets, I realized that the USD is ready to make at least one leg up, which means that EURUSD can retest the lows around 1.0560. The single most important reason is a stock market, which remains in an uptrend, especially now as E-mini S&P500 breaks above 2100 so there is room for a move up to the 2110 area minimum.

S&P500, 1H

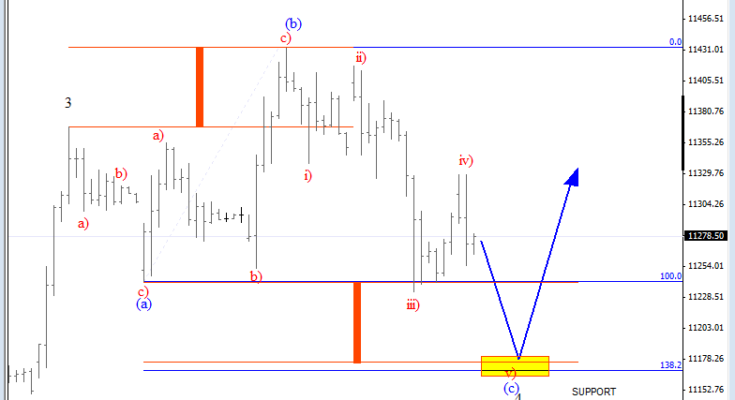

We also see German DAX trading in a corrective wave; possibly making an expanded flat in wave four might be looking for a support around the 11160/11180 region. Ideally, market will bounce from there later today.

German DAX, 1H

A Flat is a three-wave pattern labeled A-B-C that generally moves sideways. It is corrective, counter-trend and is a very common Elliott pattern.

Basic Flat Pattern: