EURUSD

Good morning traders. Today from the news side we have CPI figures in Canada. No major news on other markets. Stocks are choppy and in some form of consolidation in the last few trading days with USD gaining over hawkish FED tone.

EURUSD is still on the downside path trading in the possible final moments of black wave 3, which may rebound around the 1.1161 zone, where Fibonacci ratio of 138.2 could react as a support and a turning point. After wave 3 is finished, resistance for wave 4 can come in around 1.1240 from where we expect the continuation of the current bearish trend towards 1.1100 price levels.

EURUSD, 1H

German DAX

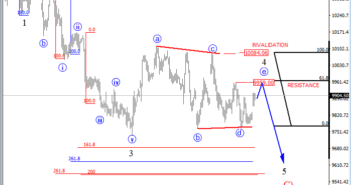

As of DAX, the price is still trading in the triangle consolidation in black wave 4, which may be in its final stages. A possible resistance region for the last leg E wave up is around 9.960-70 zone with invalidation levels at 10.084, where the high of wave C is located. If the price breaks beneath wave D lows around 9.755, then this would be the first sign of more weakness ahead.

German DAX, 4H