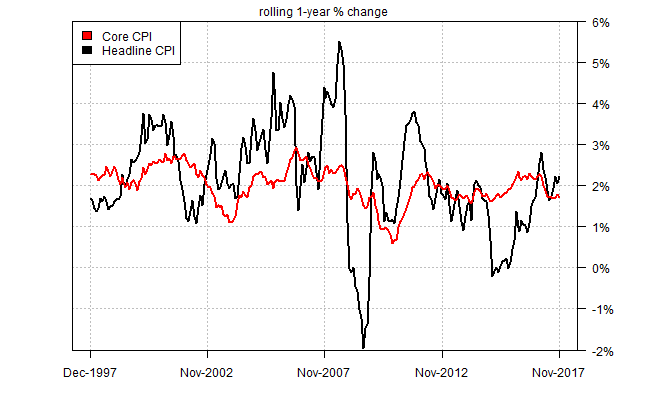

The Federal Reserve raised interest rates again yesterday, but the announcement of tighter policy followed news that the trend in core consumer inflation drifted lower. The combination of higher rates and a softer pricing pressure raise questions about the Fed’s plans for 2018.

Core consumer price inflation (excluding energy and food) ticked down to a 1.7% year-over-year increase in November, in line with recent data that marks the softest trend in more than two years. The sluggish pace suggests that the Fed will have a hard time reaching its 2% inflation target in the near term.

“The lack of a sustained pickup in core CPI does make the Fed deliberations about the pace of monetary policy tightening next year more complicated,â€Â says Kathy Bostjancic, head of U.S. macro investor services at Oxford Economics.

Nonetheless, the case for firmer inflation next year isn’t dead, explains Leslie Preston, a senior economist at TD Bank Group.

We remain confident that conditions are ripe for inflation to build in the months ahead, although the process is proving lengthy. No doubt November’s inflation data is a setback. But, the sizeable decline in apparel prices is unlikely to be repeated next month, suggesting core inflation will firm once again in December. In an economy with unemployment at a 17-year low, and back-to-back quarters of 3% growth in real terms, conditions are ripe for increased pricing power. Adding to those healthy economic conditions, Congressional Republicans look set to pass a tax cut in the coming days. This will add further to inflationary pressures in 2018.

Perhaps, although it’s interesting to note that while the Fed lifted rates yesterday, the real (inflation-adjusted) trend in M0 money supply continued to rise in November. For the fourth month in a row, this narrow gauge of monetary liquidity increased, which suggests that the Fed’s policy stance may not be as hawkish as yesterday’s rate hike implies.