After a terrible year for insurance losses, the global reinsurance industry is now celebrating.

Over the past ten years, global reinsurance rates have been pushed ever lower thanks to the low cost of capital, and demand from investors seeking improved returns on their cash. Money flooding the industry has forced down rates, and returns as well.

However, following 2017, it looks as if 2018 will be a more productive year for the industry. There are already signs that price hikes are starting to take effect.

Swiss Re is one of the most significant players in the reinsurance sector. For 2017, the company estimates that the industry as a whole will have a combined ratio of around 115% for 2017 and will report a return on equity (RoE) of -4% for the year. Nonetheless, it looks as if prices are already starting to return to normal levels across the board according to Swiss Re’s Chief Economist Kurt Karl, who at the end of November declared that “Price rises in loss-affected segments are already happening and could be substantial.â€

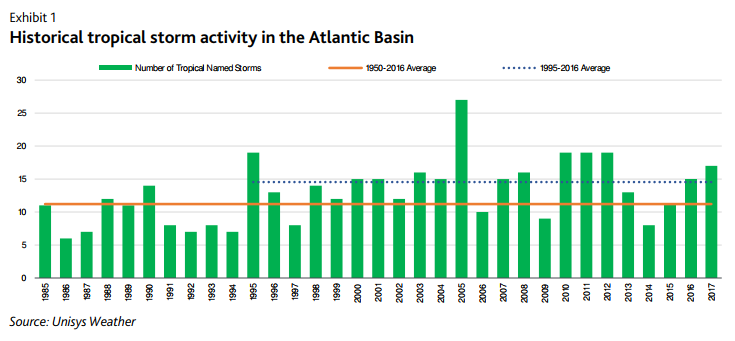

Global Reinsurance Industry: Losses Rising

According to Moody’s, following an estimated $100 billion in losses for the full year, reinsurance buyers shows that buyers are expecting to pay more for protection on loss-affected lines during the 2018 renewals, with nearly half of respondents to an industry-wide survey expecting prices to rise by more than 7.5% for 2018.

Following the California wildfires, Moody’s also expects “US property catastrophe reinsurance pricing to increase by 5% to 10% during upcoming renewal periods, with higher increases for retrocessional reinsurance programs. “

(Click on image to enlarge)

Nevertheless, despite rising losses, the rating agency is confident on the outlook for the reinsurance sector as a whole. Indeed, while it was a standout year for losses, reinsurers have been able to operate in a favorable environment for some time. Strong balance sheets have help cushion the fallout: