One month ago, Citi’s credit team laid out its outlook for the coming year in what – in our opinion – was one of the gloomiest reports for the coming year, and included the following fascinating revelation according to which central bankers appears to have lost control: “That seems to be a growing fear among a number of central bankers that we have spoken to recently. In our experience, they too are somewhat baffled by the lack of volatility and concerned about the lack of response to negative headlines… Our guess is that sooner or later in the process of retrenchment they will end up going too far – though that will only be obvious with hindsight.” As we said at the time, “frankly, that’s about the scariest admission from one of the world’s biggest banks that we have read in a long time.”

And while Citi’s “base case” was clearly bearish (our Citi’s credit team laid out its outlook  – what was left unsaid was even more interesting, if not troubling. As the bank’s credit team writes “what about the outcomes that didn’t quite make it into our base case? The scenarios that aren’t central, but which aren’t entirely implausible either – both bullish and bearish.

So ‘What if…â€:

- idiosyncratic risk is returning to credit?

- European corporates get more aggressive?

- global growth & commodity prices disappoint?

- inflation accelerates as output gaps close?

- the US yield curve inverts?

- central bank tapering really is a non-event?

- the market doesn’t like the choice of ECB successor?”

Here is Citi’s take on each of these possibilities, if not necessarily probable, scenarios:

What If…

1. idiosyncratic risk is returning to € credit?

New Look, Astaldi, and now Steinhoff. If it felt as if idiosyncratic risk was as dead as a dodo in the age of ECB QE, well then, now we know it isn’t. All three credits have at one point seen their bonds drop by more than 25 points in the last few weeks. A mere coincidence or a sign of things to come? With European default rates at 1.5%, strong fundamentals, healthy earnings growth and broad economic growth the best-guess answer has to be “mostly the formerâ€.

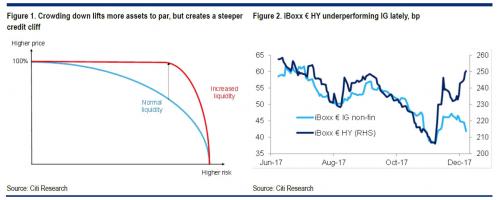

But not exclusively so. As we illustrated in our derivatives outlook, the compression of risk premia has been accompanied by a risk-bifurcation in € credit. Well, over 90% of credits are historically tight and carry very little of the overall default risk of the market, which is overwhelmingly skewed to a small number of names. Such a bifurcation happens in every bull cycle, but it has been augmented by all the central bank excess liquidity. The government bond buyer, crowded out by the ECB or money market trying to escape negative yields, moved into high-rated corporates. The buyer of high-rated corporates no longer finds sufficient returns and so moves down in quality. The eventual consequence of the excess liquidity is that the whole market ends up priced almost to perfection, except of course the credit that is at high risk of relatively imminent default. It will still trade to its recovery value (Figure 1).

The point we are trying to make is that this inevitably results in a much sharper cliff in pricing between those that are deemed to be going-concern investments and those that are deemed to be over the edge. Hence the precipitous losses (or gains) when a name shifts from one to the other.

Â

But beyond this, blow-ups do tend to come in clusters. It wasn’t just Enron; it was also Worldcom. It wasn’t just Ahold; it was also Tyco. Even if recent blow-ups have no direct bearing on other risky credits, they serve to remind investors of the risk of standing close to the brink. And there is a general tendency for, shall we say, ‘credit homework’ that gets overlooked during bull markets to be rediscovered in a hurry once losses have been incurred. As analysts rummage around there is an increase in the likelihood of something being uncovered in another name. At an absolute minimum, when large quantities of debt have been raised, as the market gets more nervous there is an increased probability of an outsized knee-jerk reaction. This has no doubt contributed to some of the recent underperformance of the HY market versus IG (Figure 2). With curious synchronicity, a similar set of worries seems to have reared its head in other regions (think Windstream and Community Health in the US, or HNA, Noble Group and Kobe Steel in Asia).