The February 2014 collapse of Tokyo-based bitcoin exchange Mt. Gox was, for more than 24,000 investors around the world, a traumatic event. It also ushered in a two-year crypto bear market that saw the price of a single bitcoin plunge from a peak of $1,200 to a low of around $200 before the torrid bull market of the present day began. And as the bankruptcy and legal issues surrounding the collapse continue to wend through the Japanese legal system, none of these investors have received a single crypto cent of remuneration – despite the ballooning valuation of the exchange’s remaining assets.

Many market observers believe that one of the biggest risks to the current rally would be a similar incident unfolding across another major exchange like Bitfinex or CoinBase’s GDAX.

So in a move that could go a long way toward legitimizing the burgeoning crypto market, Japanese banking behemoth Mitsubishi UFJ Financial Group which isJapan’s largest financial group and the world’s second largest bank holding company – through its trust and banking unit – is preparing to launch a service that will allow individual investors to secure their bitcoins in the event an exchange should fail again, according to Nikkei Asia Review.

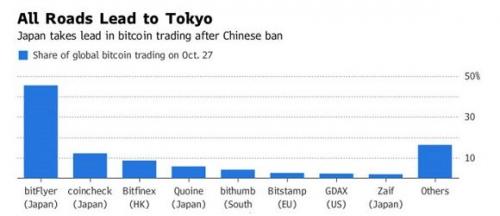

MUFG isn’t the only major global bank seeking to build up its cryptocurrency franchise: Goldman Sachs is reportedly in the process of launching a crypto trading desk. Of course, as observed recerntly, Japan is one of bitcoin’s biggest markets, and its largest exchange, Bitflyer, accounts for nearly 40% of global exchange-based trading.

MFUG’s new trust service would help mitigate what has, in the past, proven to be one of the biggest threats to the crypto market. It will also help Japanese regulators cement their position at the vanguard of crypto’s integration with traditional markets.

Mitsubishi UFJ Trust and Banking is preparing a scheme for protecting holders of cryptocurrencies if the exchanges they use fail –Â a risk that veteran fans here know all too well.

This highlights how Japan’s finance industry seeks to make the most of the opportunities associated with virtual currencies, which the country has taken to in a big way, accounting for around 40% of global bitcoin trading.

Japan was also the epicenter of one of the digital currency’s biggest shocks — the 2014 collapse of Mt. Gox, the largest bitcoin exchange at the time.

Mitsubishi UFJ Trust will offer a way to keep exchange customers’ cryptocurrency holdings separate from the entrusting exchange’s assets. This will make it the first trust arrangement of its kind in the world, according to the Mitsubishi UFJ Financial Group member, which recently applied for patent protection.