Less than 100 companies will report earnings between now and next Friday, but this week mark’s the official kick-off to the Q4 2017 earnings reporting season. Below is a list of the 30 largest companies set to report between now and January 19th. As you can see, the bulk of large-cap companies set to report over the next 10 days are in the Financial sector.

On Friday alone, we’ll hear from JP Morgan (JPM), Wells Fargo (WFC), BlackRock (BLK), and PNC. How these Financials react to their earnings reports will be an important early signal as to how investors plan to trade earnings this season. As we highlighted yesterday in a Chart of the Day, analysts have gotten extremely bullish ahead of this earnings season, hiking EPS estimates at their fastest pace in ten years. (Bloomberg featured our data in an article on this topic this morning.)

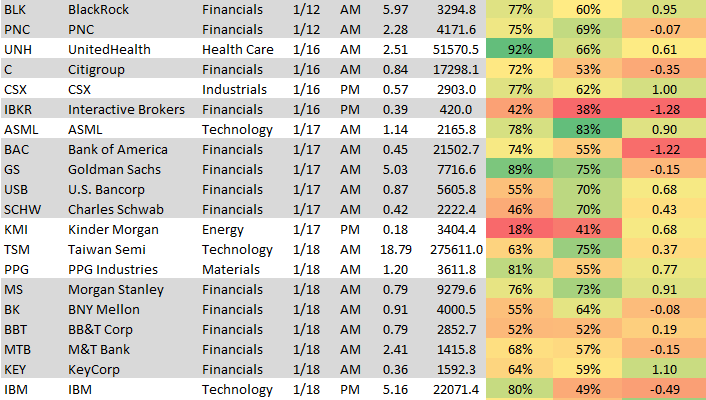

The data included in our table below is pulled from our Interactive Earnings Calendar. For each stock, we show its estimated report date and time, its EPS and revenue estimate, and its historical earnings and revenue beat rate (% of time it has beaten consensus estimates). We also show how the stock has historically traded on its earnings reaction days, which is the first trading day following its past quarterly reports.

As you can see in the table, UnitedHealth (UNH), Goldman Sachs (GS), JP Morgan (JPM), and Synchrony Financial (SYF) are the stocks set to report soon that have historically beaten EPS estimates the most often. In terms of price reactions, Delta Air Lines (DAL), BlackRock (BLK), CSX, Morgan Stanley (MS), KeyCorp (KEY), and Canadian Pacific (CP) have historically gone up the most on their earnings reaction days. Interactive Brokers (IBKR), Bank of America (BAC), and IBM have historically reacted the most negatively to earnings reports.

Â

Â