Extreme Bullishness

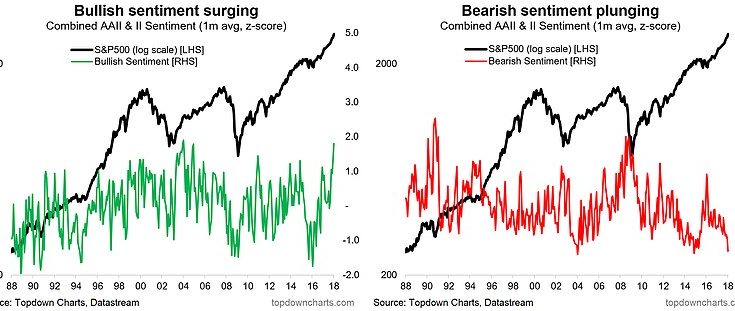

Stocks hit a record high on Wednesday as the S&P 500 was up 0.94% and the VIX recoiled from its gains on Tuesday falling to 11.54. There hasn’t been much of an effect from the crash in cryptocurrencies as I expected. If stocks continue on this unprecedented streak, I could see the Fed doing a shock rate hike to prick the bubble before it gets too large. This type of policy action won’t happen in the next two months because we’re in a transition period between Yellen and Powell. He needs to be confirmed by the Senate before anything like that happens. The charts below show the euphoria in the market. As you can see, the 4 week moving average in the two most prominent investor surveys shows that investors were only more bullish in 2003 and that this is the 3rd lowest percentage of bears. Stock speculators laughing at those losing money in cryptos should worry about how the frothiness in stocks will end.

AAPL To Invest Its Cash Hoard In America

Because Apple already borrows against its overseas cash position at low-interest rates, some investors thought it would keep the capital overseas. However, Apple announced on Wednesday that it would repatriate almost all its $250 billion cash hoard. It will pay $38 billion in taxes because of this repatriation. The company said this would be a $350 billion contribution to the economy. The company plans to hire 20,000 more workers and open a new campus. It will spend over $30 billion capex over the next year. $10 billion of that capex will be investments in U.S. data centers. The firm also increased the size of its innovation fund to $5 billion from $1 billion. Finally, the company will keep up the $55 billion in 2018 super cycle spending with domestic suppliers and manufacturers. This announcement helped lift Apple stock up 1.65% to a record high. This news boosted sentiment in the overall market as if it needed anything else to be optimistic about.

Goldman Sachs And Bank Of America Report Earnings