“The Bank of Canada today increased its target for the overnight rate to 1 1/4 per cent… However, uncertainty surrounding the future of the North American Free Trade Agreement (NAFTA) is clouding the economic outlook… In Canada, real GDP growth is expected to slow to 2.2 per cent in 2018 and 1.6 per cent in 2019, following an estimated 3.0 per cent in 2017. Growth is expected to remain above potential through the first quarter of 2018 and then slow to a rate close to potential for the rest of the projection horizon… While the economic outlook is expected to warrant higher interest rates over time, some continued monetary policy accommodation will likely be needed to keep the economy operating close to potential and inflation on target.†(Bank of Canada, January 17, 2017)

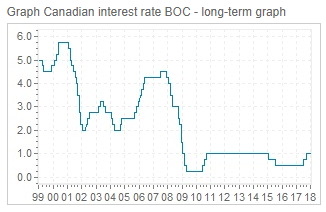

In a widely expected move, the Bank of Canada raised its key lending rate by 25 basis points to 1.25% On Jan. 17th, This represented the third consecutive increase in the benchmark policy rate from its record low-level last summer.

The BoC acknowledged that the country experienced a string of unusually strong economic releases late in 2017, and as a result, is “operating roughly at capacityâ€.

Accordingly, the BoC upgraded its Canadian GDP growth forecasts slightly to 2.2% for 2018 and to 1.6% for 2019.

The expected slowing in the Canadian economy in 2019 will be concentrated in both consumer spending and housing expenditures. As well, the Bank’s slower growth projection for 2019 is also affected by the possibility of a NAFTA trade collapse, and its negative impact of future investment and employment in Canada.Â

Â