There is something going on in the economy that no one is talking about. And it is making me uneasy. For the last decade, the world’s economies have piled on an insane amount of debt.

It’s not hard to see why this happened.

Years of near zero interest rates – even negative across Europe and Japan – allowed governments and households to borrow money for almost nothing. But that’s changing.Â

For instance – after years of low rates, the US Treasury now has over $21 trillion in debt (and this is not including unfunded liabilities).

This isn’t something new – but this is where things get scary.

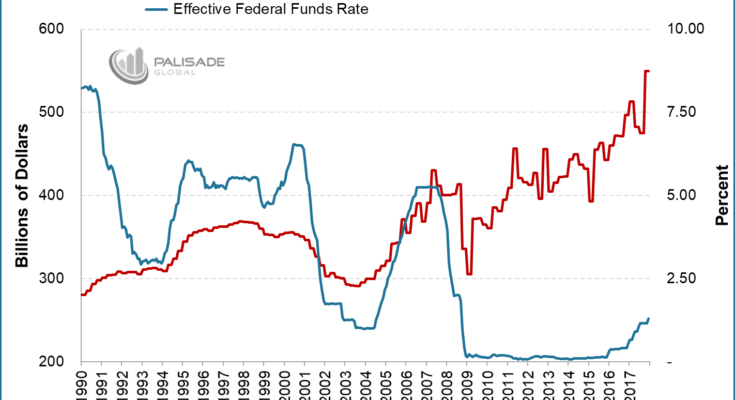

Since the Federal Reserve began raising interest rates in Q4 2015, interest payments on the United States national debt has soared 38%.

Let that soak in. A 1.25% rise in short-term interest rates has corresponded with a 38% increase in the amount of interest paid for the United States national debt.

This isn’t even accounting for the deficits coming from President Trump’s massive tax cut plan. How did we get here?

It went something like this. The Federal Reserve wanted to boost growth and consumption in the economy. So, they lowered interest rates to get things going. This allowed Joe and Karen to go out and refinance their house, finance a new car, buy things on their credit cards – and everything else they can do to live above their means.

Thanks to low interest rates, they only have to make small payments to keep their lavish lifestyle. Looks like a win-win, right? The Government gets their growth and big spending policies, and Joe and Karen get to live nicer.

That is, until interest rates rise. All of a sudden – after years of Joe and Karen piling debt onto their plates – they now have interest payments doubling across the board. Their mortgage, cars loans, credit cards, student debt – all of it.