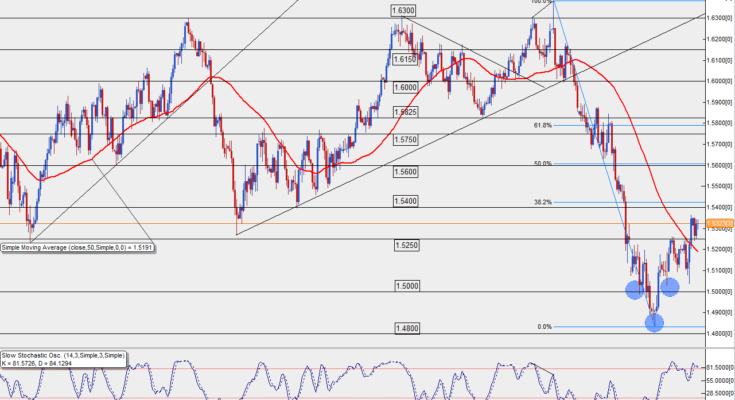

GBP/USD (daily chart) as of April 10, 2013 has continued to take on a short-term bullish bias as the pair looks to extend its one-month recovery from the mid-March low around 1.4830. The current rally from that low can be seen as a short-term bullish correction of the steep bearish trend that has been in place since the very beginning of the year. Thus far, this bullish correction has not yet even reached the 38.2% Fibonacci retracement of the bearish trend, and so should not be considered a trend reversal as of yet. However, this recovery may prompt a move further to the upside before potentially moving towards a resumption of the entrenched downtrend.

After breaking out above key 1.5250 resistance late last week, price made a pullback to that level (now as support) and rebounded. Further upside momentum on the recovery should find major nearby resistance around 1.5400 and then 1.5600, which is in the vicinity of the 50% Fibonacci retracement of the noted downtrend extending back to the beginning of the year.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.