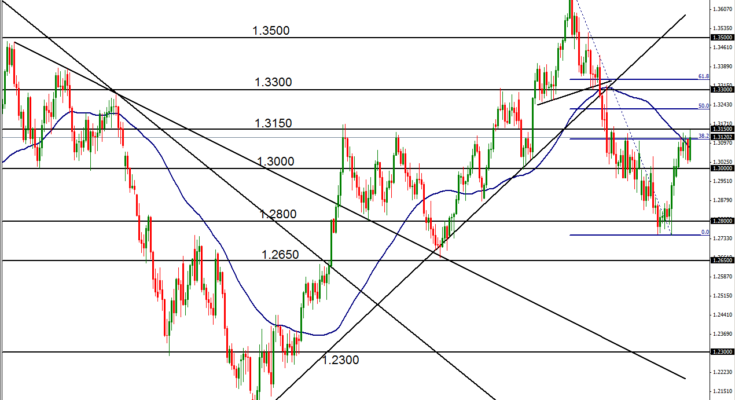

EUR/USD (daily chart) as of April 16, 2013 has rallied in early trading today, regaining the ground lost during yesterday’s decline. The past week has seen clear respect for resistance around the 38.2% Fibonacci retracement level of the two-month plunge beginning in early February above 1.3700 down to the double-bottom low around 1.2750 in late March and early April. After that double-bottoming pattern, price has climbed steadily in a net bullish correction for the past two weeks.

Today’s rally has so far climbed only slightly above the noted 38.2% Fibonacci retracement level, hitting strong resistance at 1.3150 and placing EUR/USD at a critical juncture. Clearly, a breakout above 1.3150 would extend the current bullish correction, with an objective towards further upside resistance around 1.3300. If the 1.3150 level and the 38.2% Fib level are respected with a turn to the downside, a subsequent breakdown below the key 1.3000 level could trigger a resumption of the bearish trend towards 1.2650 and below.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.