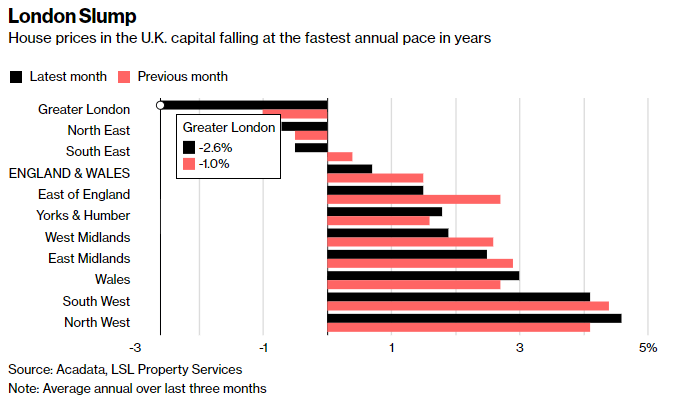

After a decade of soaring prices, spurred on by hot money flows from Russia and China, London’s 2017 property slowdown is accelerating in 2018 as Bloomberg reports house prices are falling at the fastest pace since the depths of the recession almost a decade ago, with the capital’s most expensive areas seeing the biggest declines.

Average prices fell 2.6% to 593,396 pounds ($820,000) in January, according to a report published by Acadata on Monday. That’s the most since August 2009.

London’s highest-priced boroughs were the biggest losers over the last year, while the largest single drop was recorded in Wandsworth, down almost 15 percent.

Wandsworth and Southwark are home to huge speculative property developments facing on to the River Thames – including the Battersea Power Station development – but the market for £1m-plus one-bed properties has shriveled in recent years.

But,  Bloomberg reports anecdotally it’s considerably worse according to realtors:

Business has been slow in “a lot†of offices since the start of the year, though there are more deals being done in some central outlets, Simon Aldous, a director at Savills, said in a survey published last week by the Royal Institution of Chartered Surveyors.

Offers for homes are often more than 10 percent below asking prices, James Gubbins, a partner at Dauntons in Pimlico, said in the poll.

“Uncertainty over Brexit is the issue,â€Â Gubbins said.

Media coverage of the slowdown, including headlines about falling house prices, is making consumers nervous and holding back demand. New buyers registering with real-estate agents fell for an 11th month in February, RICS said last week.

The slump in London home prices has weighed on national prices too as home price inflation has dropped to its lowest since Feb 2012:

Increased taxes on landlords and loan limits in Singapore have also helped to damp demand from overseas, and as Lucian Cook, head of residential research at broker Savills Plc, warns, a decade of soaring prices means London’s more exposed to political and economic uncertainty, the prospect of interest rate increases and mortgage loan limits.