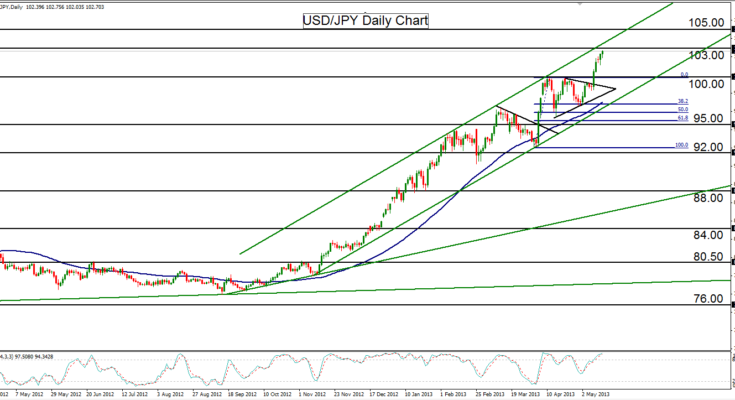

May 15, 2013 – USD/JPY (daily chart) has continued its advance to approach a major upside resistance target around 103.00. This occurs after the pivotal breakout above 100.00 that occurred late last week, after which the pair has hardly paused in its almost relentless climb towards higher multi-year highs. While the bullish trend bias is currently clear and sustaining, USD/JPY should be due for another downside correction before potentially reaching back up once again towards even loftier levels. The most well-defined downside support objective for this potential correction resides around the key 100.00 level, as prior resistance may well become future support. Further upside targets on a continuation of the entrenched bullish trend reside around 105.00 and then 108.00.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.