Collectively, the central bank sector claims to hold the world’s largest above-ground gold bar stockpile, some 33,800 tonnes of gold bars. Individually within this group, some central banks claim to be the top holders of gold bullion in the world, with individual holdings in the thousands of tonnes range.

This worldwide central bank group, also known as the official sector, spans central banks (such as the Deutsche Bundesbank), international monetary institutions (such as the Bank for International Settlements) and national monetary authorities (such as the Saudi Arabian Monetary Authority – SAMA).

These institutions hold gold as one of their reserve assets. Any gold held by a central bank as a reserve asset is classified as monetary gold. In addition to monetary gold, central bank reserve assets include such things as foreign exchange assets (such as US Dollars) and IMF Special Drawing Rights (SDRs). In general, reserve assets held by central banks are managed according to the criteria of safety, liquidity, and return.

Note that most of these central banks don’t own the gold they hold, but merely hold it on behalf of their nation states. See “Who Owns the World’s Largest Gold Hoards? – Not the Central Banks!†on the BullionStar website for a discussion of official gold reserves ownership.

Given that central banks don’t generally divulge the gold that they lend, swap or otherwise use as collateral, the question as to whether the official sector actually holds 33,800 of gold or far less than that amount, is debatable. But for the purposes of this discussion, the amount of gold that the central banking sector holds is not important.

This discussion focuses on why central banks hold gold. This discussion also uniquely draws on actual responses from many of the world’s largest central banks as to why, in their own words, they hold gold. While the common reasons for central banks holding gold range from store of value, to financial insurance, to asset diversification, we thought its best to let the actual gold holding central banks state their case.

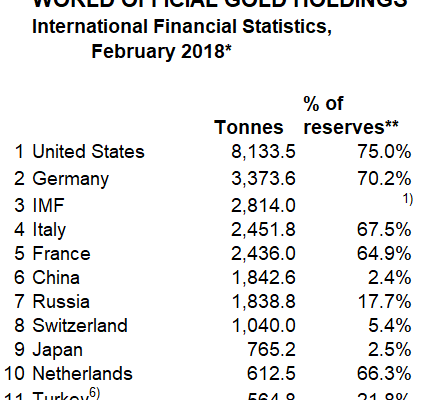

Taking the list of official sector gold holders compiled by the World Gold Council (which uses IMF data sourced from the individual banks), the Top 40 gold holders on this list were identified. While most of the Top 40 gold holders are national central banks or equivalent, there are also a small number of international monetary institutions in the Top 40, namely, the Bank for International Settlements (BIS), the European Central Bank (ECB), and the International Monetary Fund (IMF). A similar question was sent out to each bank and institution. The question was:

“in the context that central banks hold gold as a reserve asset on their balance sheets, can Central Bank X clarify the main reasons why it continues to hold gold as a reserve asset?â€

The central banks which responded to this question with constructive or definitive answers were as follows:

Germany

Germany’s Deutsche Bundesbank, which is most famous recently for repatriating gold from New York and Paris, but which still stores gold in London and New York, placed a particular emphasis on gold’s high liquidity, as well as gold’s powerful role in financial crises and emergencies:

“The part of the Bundesbank’s gold reserves which is to remain abroad could, in particular, be activated in an emergency. Therefore one part will remain in New York following completion of the relocation – the United States has the most important reserve currency in the world – and one part in London, the world’s largest trading centre for gold.

In the event of a crisis, the gold could be pledged as collateral or sold at the storage site abroad, without having to be transported. In this way, the Bundesbank could raise liquidity in a foreign reserve currency. However, these are purely precautionary measures as we are not expecting this kind of contingency scenario at the current time.Â

Gold is a type of emergency reserve which can also be used in crisis situations when currencies come under pressure.â€

Austria

In neighboring Austria, the Oesterreichische Nationalbank (OeNB), Austria’s central bank, also mentioned the liquidity characteristics of gold, its benefits in a crisis, and also gold’s diversification benefits. The OeNB also recently made headlines when it too repatriated some of its gold back from storage in London. The OeNB told BullionStar that:

“Gold is an essential part within our strategy for crisis prevention and crisis handling and is held as liquidity reserve but is also a means to diversity our investments.â€

Switzerland

Staying in the region, Switzerland’s central bank, the Swiss National Bank (SNB) highlighted the diversification and risk optimisation benefits of gold, responding that the National Bank holds gold because:

“As part of a good diversification of currency reserves, a certain proportion of gold can help reduce the balance sheet risk. The Swiss Federal Constitution, art. 99 stipulates that the SNB has to hold a part of its currency reserves in gold.

See also the speech given by Fritz Zurbrügg, Vice Chairman of the Governing Board of the SNB; it contains comments on the role of gold in the SNB’s currency reserves: â€

Article 99 of the Swiss Constitution in part says that “the Swiss National Bank shall create sufficient monetary reserves from its profits; a part of these reserves shall be held in gold“.

Fritz Zurbrügg’s speech cited by the SNB, which was mostly a politically loaded SNB attack against the 2014 Swiss gold referendum more than anything else, says in part that gold reserves can be used in crisis management and that the SNB’s gold is “stored in multiple locations for reasons of risk diversification“.

Poland

The Polish central bank, Narodowy Bank Polski (NBP), provided a very detailed answer to BullionStar covering gold’s lack of credit risk and counterparty risk and its finite supply, as well as gold’s safe haven and diversification benefits: The NBP said that:

“Gold, due to its attributes is a quite specific asset, and traditionally has been an important component of central bank’s foreign reserves.

The main features which support the unprecedented role of gold at the same time constitute the rationale for holding gold within central bank’s reserves. These are: lack of credit risk, independence from any country’s economic policy, limited size of the resource, physical features such as durability and almost imperishability.

Additionally, gold has been constantly perceived as a safe haven asset, and is particularly desirable in crisis times, when gold prices increase while other core assets’ prices have a downward tendency.â€