Today’s 25bps hike in rates to 1.75% will have little impact on how much interest is paid to the trillions of dollars held in checking and savings accounts across the US (simply because banks continue to drown in over $2 trillion in excess reserves and thus do not really need all those deposits). It will, however, have a notable impact on how much cash the Fed pays out to banks in the form of interest on excess reserves (just don’t call it a subsidy).

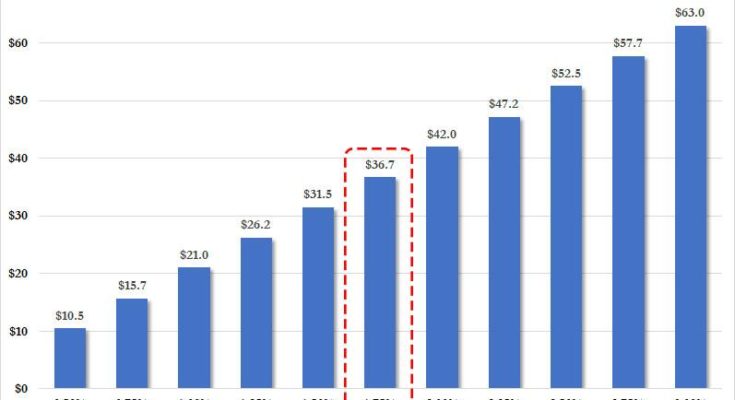

As the chart below shows, after today’s rate hike, the Fed will be paying $37 billion in annualized interest to banks, an increase of $5 billion from the last rate hike.

(Click on image to enlarge)

The chart above shows the monetary gift the Fed gives to banks for not lending out money to the system, and keeping the velocity of money at all time lows.

And, assuming the Fed hikes another 2 times in 2018, the Federal Reserve is on track to pay out $47 billion in subsidiesIOER to banks for the privilege of bailing them out a decade ago, as the following chart from Deutsche Bank shows.

(Click on image to enlarge)

h/t Capital Trading Group